The annual, global demand for therapeutic peptide APIs is estimated to be 2,145 kg in 2020, and this value is projected to reach about 3,800 kg by 2025, growing at a CAGR of 10%. Given that majority of the approved peptide drugs have lost patent exclusivity, the current demand is driven by both generics and new drugs, equally. In the mid-long term, this scenario is likely to evolve as new peptide drugs receive approvals. It is worth highlighting that in 2017, there were 7 peptide drugs approved by the USFDA.

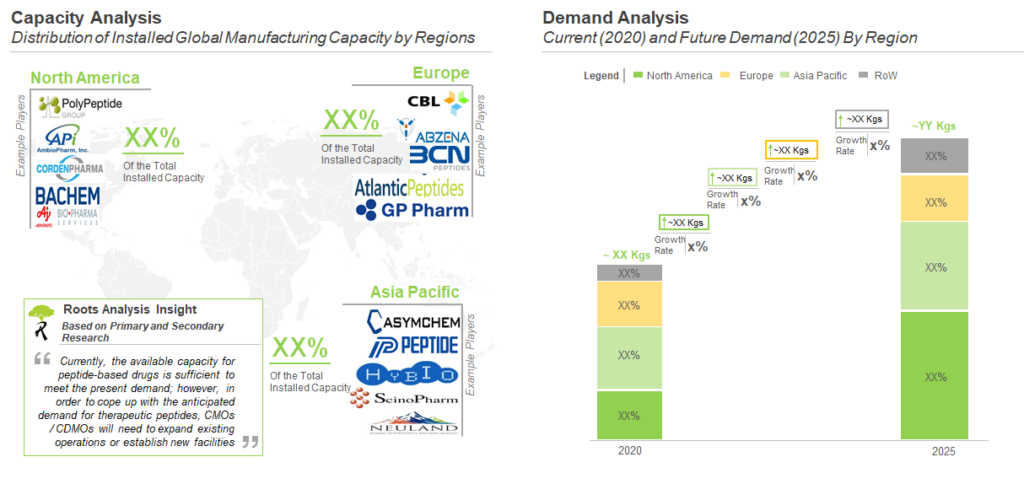

The maximum share of the current manufacturing demand is captured by North America (48%), followed by Europe (30%), and is expected to increase in the near future.

The global, annual capacity for small molecule APIs is primarily driven by the large and mid-sized companies. The large and very large sized companies contribute to a majority share of the overall peptide API contract manufacturing capacity. Although, there is a relatively higher number of mid-sized players in the peptide API contract manufacturing market, the global production capacity is undisputedly being driven by large and very large players.

We have further analyzed the installed global capacity based on the scale of operation (preclinical / clinical and commercial) of the manufacturer. The companies operating at the commercial scale capture 82% of the total capacity. Example of companies that offer peptide API production services at all scales of operation are (in alphabetical order) AmbioPharm, CordenPharma, CPC Scientific and PolyPeptide.

Majority (40%) of the peptide API contract manufacturing capacity is installed in North America. Example of companies with manufacturing facility(s) in North America are (in alphabetical order) Anaspec, Creative Peptides , CSBio and RS Synthesis. This is closely followed by Asia Pacific, which captures 34% of the overall, installed capacity for manufacturing of peptide APIs. Example of companies that have established manufacturing facility (s) in Asia Pacific are Auspep, ChemPartner Hybio Pharmaceuticals and Peptide Institute. Further, it is important to highlight that various peptide API production facilities are located in Europe.

Currently, North America holds the maximum capacity for contract manufacturing of peptide APIs. This can be attributed to the availability of advanced manufacturing technologies and issuance of socio-economic reforms, favoring the growth of peptide therapeutics industries, in the aforementioned region. We further believe that, as more therapeutic peptides are approved, manufacturing demand for such products is likely to grow significantly in the foreseen future. This increase in demand is further anticipated to translate into a huge opportunity for players having necessary capabilities for the manufacturing of peptide APIs. Finally, as more peptide therapeutics are advancing into the later stages of the clinical trials, the CMOs are required to increase their manufacturing capacities through internal expansions, acquisitions and mergers. In addition, the CMOs need to build upon their technological capabilities to combat the increasing demand of peptide therapeutics.