In today’s competitive age it has become an unsaid rule for businesses to maintain an online store or website. However, architecting a business application to sell services or products digitally; is not so simple as it sounds. The reason is, numerous aspects are to be taken care of, the most challenging part being the selection of the apt payment gateway for online transactions. This is because not picking the right payment channel may lead to the rejection of your enterprise app even if you offer the best deals. Out of the existing payment processing companies, the ones that are preferred by most successful online businesses are Stripe and PayPal, owing to their convenience quotient and safety standards. Now, comes the trickiest question: “Which payment gateway outsmarts the other?” In reality, both Stripe and PayPal provide commendable payment processing services. As such, it becomes difficult for entrepreneurs to select the appropriate one. However, these two popular payment gateways are different in certain ways and an entrepreneur must choose the one that best satisfies their business requirement.

This article compares Stripe and PayPal based on certain yardsticks, to help you understand which one befits your online business.

Role of a payment gateway

A payment gateway is a payment service that allows the eCommerce provider to authenticate the credit card payments or direct payment processing for online sellers, retailers, ebusinesses, etc. A payment gateway and a merchant account for processing digital payments are provided by payment service providers. Unlike most other providers, Stripe and PayPal are called aggregators as they group all clients into one huge merchant account instead of providing separate ones to each client. This speeds up payment processing approval for clients.

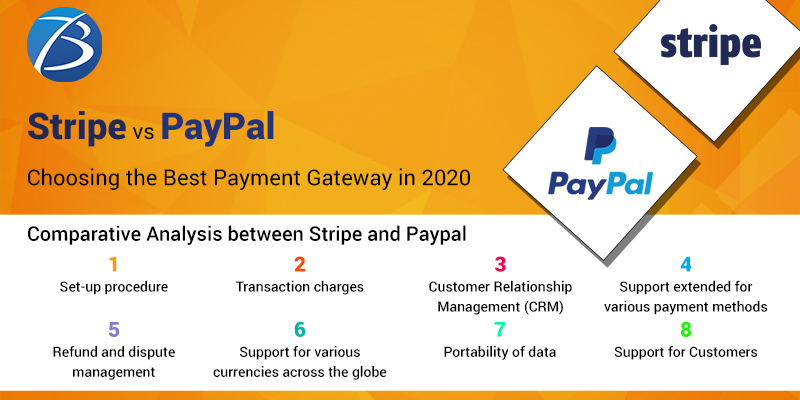

Stripe versus PayPal: A Comparative study

Let’s compare Stripe and PayPal based on the following parameters.

Set-up procedure

Both Stripe and PayPal is easy to set up using WPF forms. However, Stripe is more customizable as compared to PayPal. But for embedding a functionality such as a payment card button; Stripe needs more development skills and may turn out to be complicated for non-technical users.

Transaction charges

The basic transaction fee is the same for both Stripe and PayPal – 2.9% of online sales plus $ 0.30. Also, both do not charge any monthly fee which means that not a single penny is to be paid when a business is not able to sell anything. However, the transaction charges involving international sales are 3.9% for Stripe, and 4.4% for PayPal. Therefore, if you are selling products internationally Stripe turns out to be more profitable. On the other hand, PayPal charges you lesser in case of micropayments -transactions below 10 $ in comparison to Stripe.

Customer Relationship Management (CRM)

Both PayPal and Stripe support most CRMs irrespective of the platform being used. Hence, businesses can easily integrate their website with these payment gateways with the help of their plugin or their API. The only difference here is that Stripe supports a bit more CRMs as compared to PayPal.

Support for various currencies across the globe

PayPal operates across more than 200 nations and supports 25 currencies in all. But it restricts its service in certain countries such as Sudan, Belarus, Liberia, etc. Stripe, on the contrary, is present in 26 countries but accepts payment from any part of the world. Moreover, Stripe supports more than 135 global currencies.

Support extended for various payment methods

PayPal accepts payment from only a handful of renowned credit cards like American Express, Visa, Master Card, JCB, etc. Stripe, contrarily, accepts payment from most of the known credit and debit cards as well as e-wallets such as Apple Pay, Google Pay, Amex Express Checkout, Alipay, Microsoft Pay, WeChat, Visa Checkout, etc. regardless of their popularity across the world.

Refund and dispute management

Generally, the users can file for a chargeback in cases when the item is not received, the item turns out to be defective or damaged, credit card charges were not recognized, payment was not authorized or the customer was charged more than once for one transaction. Once a chargeback has been approved, the buyer is reimbursed with the desired amount and the seller needs to pay chargeback fees.

PayPal imposes a charge of $20 on the seller while Stripe levies $15 as chargeback fees. One added advantage is that the novel Stripe Radar Functions enables online merchants to avoid card scams. Hence, you should go ahead with Stripe if you are certain about the possibility of chargebacks on your digital store and wouldn’t like to end up paying a lot for the same.

Portability of data

If you wish to switch to a different payment processor, Stripe enables you to transfer the entire credit card data in a PCI compliant manner whereas data portability options for PayPal is not so user-friendly.

Support for Customers

PayPal offers customer support via emails, phone calls, live chats, social media, etc for the questions asked by customers on PayPal’s online forum. Stripe, on the contrary, offers a 24/7 customer support option using a paid premium model apart from what Paypal offers. Customers can speak to Stripe’s agents through online chats and can utilize their IRC channel when they require immediate technical assistance.

Final verdict

We hope that the above article has given you a better insight into which payment gateway should you opt for. For entry-level sellers, Paypal can be a better option because volume discounts start at $3000 for monthly sales and they offer reasonable fees for micropayments. Seasoned merchants with good development team support may opt for the customization option provided by Stripe. Fees of Stripe becomes more attractive as the business grows.

Reach out to Biz4Solutions, a well-known mobile app development company, and a reliable technology partner in case of any further queries at [email protected].

For more details please visit:

React Native App Development Company