The income statement (P&L) is an important financial statement for reporting the financial performance of a company. It can also be referred to as the income and expense statement.

Main features of an income statement

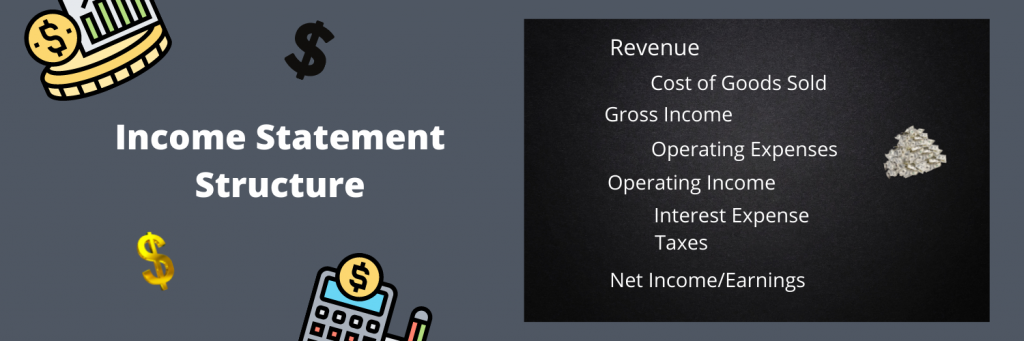

An income statement reports on financial performance during a given accounting period. The formula for this is to take the total income and profits and then subtract the total expenses and losses. This gives you the total net income.

Net income = revenues – expenses

An income statement provides important insight into a company’s operations. It shows underperforming areas, the efficiency of operations, and the effectiveness of management. It also provides information about a company’s performance compared to its competitors.

Visit also: Accounting outsourcing for Chartered Accountants in Canada

Profits and sales

Profits and sales are included in an income statement. However, their format can vary. It varies depending on the size of the business, related and local regulatory requirements.

Operating income and non-operating income

Operating revenues come from primary activities. Whether you are a retailer, distributor, or wholesaler, revenue is generated from the sale of a product or service. Operating revenue is the money you receive from exchanging money for services or products.

Non-operating revenues come from secondary business activities. They are considered non-operating recurring revenue. This revenue comes from activities outside of selling a service or product. It may be revenue from interest income, revenue from business partnerships, or revenue from advertisements on real estate.

Profits

Profits are considered other income. It may be income from no business activity, income from the sale of business equipment, or income from the sale of long-term assets.

It is important not to confuse revenue with income. Revenue is recognized when money is received. Revenues are the money that is recognized in a given period of time, such as when goods or services are delivered.

Losses and expenses

Expenses are the costs incurred by a business to maintain operations and make a profit. Some expenses can be written off if they meet IRS guidelines.

Primary Activity Expenses

Primary activity costs include depreciation, administrative costs, cost of goods sold, and development and research costs. Common items on this list include expenses for your utilities, sales commissions, and employee salaries. Expenses for ancillary activities include things like interest payments on loans. Losses as expenses include things like money spent on litigation and the loss of money from long-term assets.

Primary revenues and expenses provide insight into the core performance of the business. Secondary revenues provide insight into the management performance of the business.

The purpose of an income statement

The purpose of an income statement is multi-faceted. It shows stakeholders the profitability of a company. It provides internal financial information for comparison with other industries. It also allows a company to review the progress of current operations. With an accurate income statement, companies can make decisions about assets, sales, new regions, ramping up new production, and closing a product line.

The bottom line is that an income statement gives a company deep insight into many aspects of the business. A company can use an income statement to see which areas are causing a loss and which are causing a profit. If you are unsure how to create an accurate profit and loss statement for your business, consider hiring an outside professional to do the job. There are many companies to which you can outsource this task