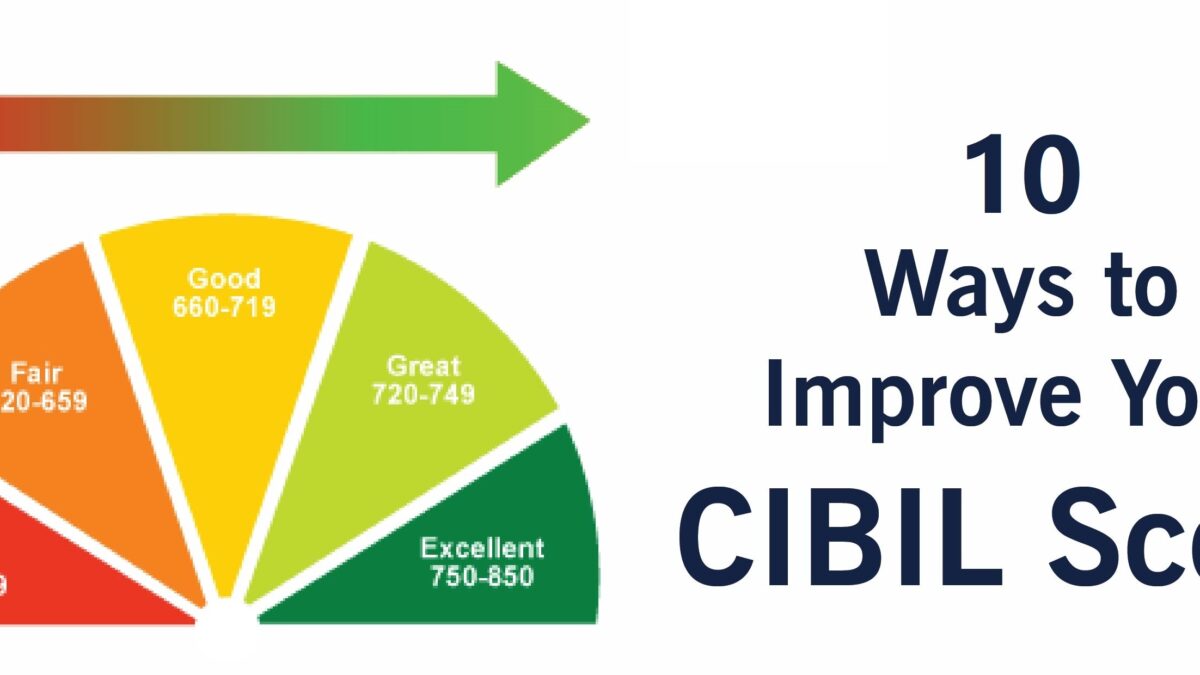

Have you at any point viewed the results of a low CIBIL score prior to considering How to Improve a Low CIBIL Score? A low CIBIL score can place you in a tough situation since banks may not consider you financially sound and may charge you an exorbitant loan fee or even oddball your advance application.

You can further develop your CIBIL score by focusing on your reimbursement propensities. A decent CIBIL accompanies a ton of advantages. Besides lower loan fees, having a decent CIBIL score accompanies a large number of different benefits. A high CIBIL rearranges and facilitates the advanced application process since banks believe the candidate to be more trustworthy. Nonetheless, in light of the fact that you have a low CIBIL doesn’t mean you won’t be endorsed for a credit. You can continuously further develop your CIBIL score prior to applying for credit, yet remember that it can’t be worked on for the time being. It requires investment and tolerance to further develop your Credit score.

In any case, paying little mind to how low your Credit score is, you can further develop it. The lower your CIBIL score, the more it will take you to further develop it. Besides the benefits of having a high CIBIL, it is expected in certain spots to try and get your credit application supported.

How to Improve or Increase Your CIBIL Score

It’s not the apocalypse assuming your CIBIL score is low. You can further develop your IILBC score by making the fitting strides. Keeping a solid financial assessment requires restrained credit from the board. However, you will not have the option to further develop your FICO rating for the time being, following these means will assist you with doing as such. A sensible time period for reestablishing your FICO rating is 4 a year. All you really want is persistence, commitment, and discretion to arrive at your credit objectives.

The following are a couple of tips to further develop your CIBIL Score:

Keep a Healthy Secured-to-Unsecured Debt Ratio in Your Credit Portfolio

Gotten and unstable advances are the two sorts of credits accessible. Assuming a borrower takes on an extreme number of unstable credits, banks, and monetary establishments are probably going to consider it to be a warning and may dismiss your advance application through and through. To stay away from this present circumstance, a borrower can take both unstable and got credits, for example, those for vehicles or houses, which is one of the manners in which they can figure out how to keep their CIBIL scores up from here on out. It’s additionally significant that Mastercards are a sort of unstable credit advance.

By no means Should You Pay Off any Loans or Credit Cards

Settlements on Visas or credits don’t further develop an individual’s CIBIL score. To settle an advance or Mastercard, the borrower moves toward their bank and demands an arrangement, ideally one that permits them to close the obligation for a lower sum than what is owed. Banks in all actuality do some of the time oblige such demands, yet the settlement understanding that was arrived at makes an imprint on the credit report, which harms the score or a bank’s eagerness to stretch out new credit to them.

Pay Your EMI Payments on Time

Continuously pay on time in the event that you have any ongoing EMI installments or month-to-month or yearly portions for a running buy like a vehicle, cell phone, home, or other huge buys. Quite possibly the most basic component influencing your CIBIL score is on-time reimbursements. They further develop your FICO assessment.

Dealing with Multiple Credit Lines

The loan specialist assesses your credit report each time you apply for another credit line. A hard request is a term for this sort of examination. It plays out a definite investigation of your credit profile to decide your gambling level. An excessive number of troublesome requests in a brief period can fundamentally bring down your CIBIL score and cause a huge drop.

Downplay the Number of Loan Applications

The third thing on the rundown of things that can be utilized as a reaction to the inquiry “How to further develop your CIBIL score?” is chevalier. is keeping the number of uses a borrower should finish up and ship off banks to a base, as credit authorities like CIBIL monitor these things also. Besides, the moneylender’s delegate is expected to check your credit reports, and such requests are recorded by organizations like CIBIL. A bank’s requests can likewise bring down an individual’s CIBIL score. Such activities have one more arrangement of results. The first is that you will be marked as a credit searcher, and the second is that your financial assessment will endure altogether, regardless of whether you have each goal and capacity to speedily reimburse the credit. Thus, if you need to figure out how to work on your CIBIL, you should likewise figure out how to keep it from decaying.

Pick a Credit Mix

Acknowledge ought to be gotten for the alert. Specialists suggest acquiring an assortment of credit types, including unstable and got advances. As you actually serve a wide scope of credit reimbursements, this can assist you with further developing your financial record. It can assist you with raising your CIBIL score and open up more credit choices.

Demand a Credit Limit Increase

Assuming that you think you’ll require more credit, you ought to get a higher credit limit. Along these lines, you can maintain your credit usage low while making the most of bigger credit open doors. Subsequently, your CIBIL score will rise.

Monitor Old Debts

The CIBIL score is determined by utilizing your record as a consumer. Therefore your CIBIL score expects you to monitor your credit accounts. Regardless of whether you use them, you ought to keep your old records dynamic. Save the verifiable record however long you can assuming you have a decent reimbursement history.

Stay away from Risk

The credit report distinguishes gambles in a borrower’s profile immediately. Continuously make sure to make charge card installments, make lower installments on the all-out due, and so forth. These are the primary indications of stress in your credit profile and demonstrate an extended income.

Keep up with Consistency

The CIBIL score can not be better in a brief period. It requires supported exertion. Accordingly, while attempting to further develop your CIBIL score, you should show restraint. Keep up with consistency in your endeavors and keep tabs on your development over the long run. Check your CIBIL score consistently to keep up with monetary discipline.

After a Loan Settlement, How Can You Improve Your CIBIL Score?

An advance settlement might bring down your regularly scheduled installments, however, it will hurt your FICO rating. To further develop your FICO assessment in the wake of settling your advance, you should:

- Cover each of your bills on time.

- Keep your credit usage proportion low.

- Make no quick credit requests.

- Layout a record

After a Loan Settlement, How Long Does it Take to Rebuild Credit?

After a loan settlement, it’s impossible to say how long it will take to rebuild your credit. It is dependent on your credit history and credit score.

Also Read: