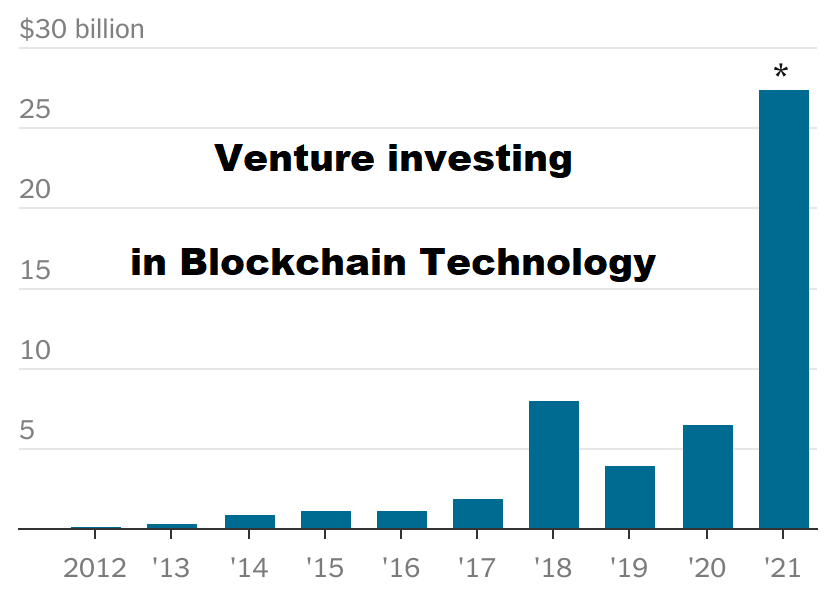

Crypto venture capital funds are gaining in popularity day by day. More and more entrepreneurs seeking funding for their ideas are taking advantage of their regular assistance. Last Year was a record year for VCs, just as it was for the market of digital assets. Among the companies that have funded their ventures with VC support are also projects in the area of cryptocurrencies and blockchain technology. Traditional VC funds invest in projects at a very early stage. In return, they give, among other things, their know-how and contacts, which enable young businesses to gain the necessary knowledge and go beyond the small enterprise zone.

Decentralized Venture Capital

Due to the growing popularity of Web3, a new vision is beginning to take shape in the minds of investors. For example, the founders of Lucrosus Capital have set the goal of creating a decentralized Venture Capital, adapting to the realities of the cryptocurrency market, and taking advantage of the new opportunities created by the blockchain. Decentralized venture capitalists is not only a great opportunity for a good way to put your money, but a new fundraising and investment model that allows non-accredited investors to invest in promising start-ups around the world. The advantage of this is that the entire investment process – from inception and screening through analysis and negotiation. This Method Protects the interests of DVC platform investors. They can then make informed decisions about who gets funded and who does not, based on an in-depth knowledge of each company’s business plan. Large, well-capitalized VC firms soft prevent small start-up VC firms from participating in lucrative traditional venture capital deals, and with blockchain, anyone can run crypto venture capital funds and become an investor. The ability to tokenize securities is an important feature of decentralized venture capital whois significantly different from the traditional order. With blockchain, we can build a fair business world, cutting out the middlemen and democratizing opportunities.

Advantages and disadvantages of VC funding in crypto

VC firms are looking for high returns, which translates into the capital with a potential quick exit. There Can be pressure to deliver quickly, as well as the risk of losing some control. Of the advantages of being a capital recipient, we can mention that it gives the cryptocurrency startup a sense of legitimacy. Despite the disadvantages, VC investment helps build fantastic business relationships, which is a very important aspect.