There are a lot of similarities when it comes to the syllabus in all three courses – CA, CS and CMA. However, the main focus of CA is Finance, Auditing and Tax. The main focus of CMA is the in-depth study of Cost and Management Accounting whereas CS gives you a detailed study structure for Company Law and Company Secretaryship.

Chartered Accountant (CA):

A Chartered Accountant, sometimes known as a CA, is a professional accountant who is employed by both individuals and businesses to do financial tasks such as inspecting financial accounts, submitting corporate tax filings, and providing financial advice. Overall, they assist with a company’s financial obligations. CAs also have the option of specialising in one field of employment.

A Chartered Accountant is recruited to help improve a company’s exterior look. To put it another way, a CA’s function is to help and advise shareholders and investors on financial matters.

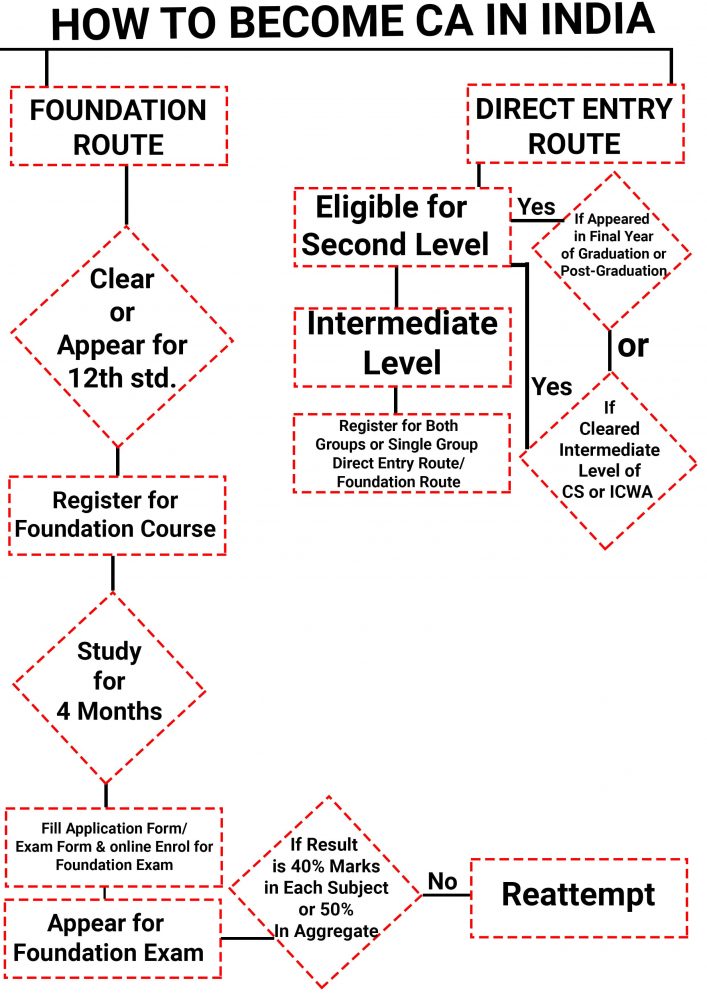

To become a CA in India, you must finish the Institute of Chartered Accountants of India’s CA Foundation, Intermediate, and Final courses (ICAI).

Cost and Management Accountant (CMA):

A Cost and Management Accountant, sometimes known as a CMA, is in charge of the allocation, management, and control of finances in any firm. These are the responsibilities of a Cost and Management Accountant. A career as a CMA is both satisfying and lucrative, as well as prestigious.

A CMA is primarily concerned with a company’s internal operations and the activities that need be taken within the organisation.

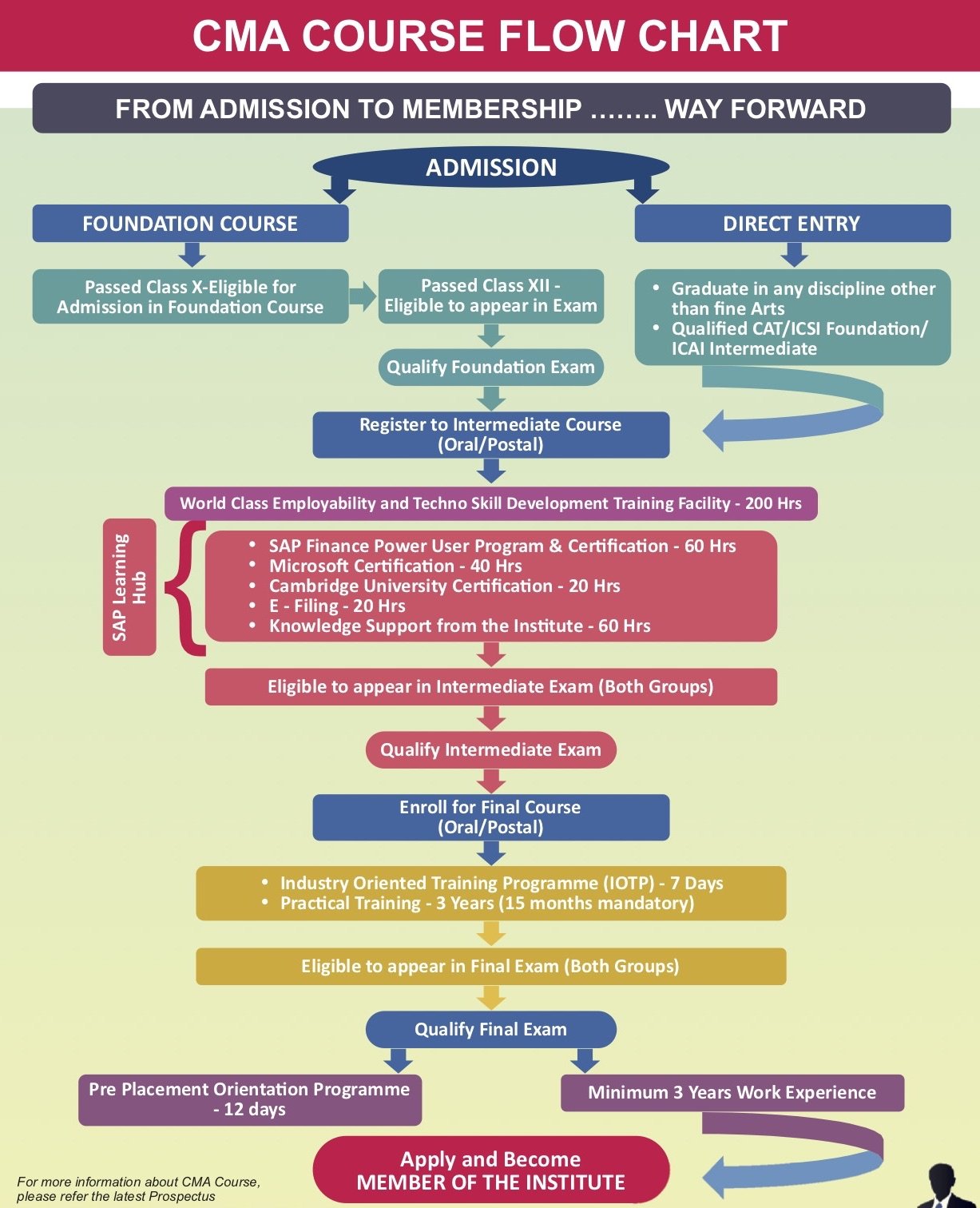

In order to become a successful CMA in India, you must finish the Institute of Cost Accountants of India (ICMAI) CMA Foundation, Intermediate, and Final courses, and there are several benefits to taking this CMA course from such a prestigious and sought-after organisation.

Company Secretary (CS):

A Company Secretary, often known as a Corporate Secretary or just Secretary, is a person in charge of ensuring that all workers and the board of directors comply with statutory, regulatory, and legal obligations. A CS is also in charge of ensuring that all board decisions are carried out successfully throughout the organisation. A Business Secretary’s responsibilities include ensuring that every employee – lower, middle, and senior management – follows the law, keeping and maintaining company records, and communicating with shareholders and directors, among other things.

To become a CS in India, you must pass the Institute of Company Secretaries of India’s CS Foundation, Executive, and Professional courses (ICSI). There are several benefits to taking the institute’s CS course.

Career Options after completing CA (Chartered Accountant):

There are several benefits to taking an ICAI CA course. The job of Chartered Accountant is highly valued, and the need for CAs is always increasing. It, if you’ve decided to become one, now is the greatest moment to do so.

- Getting into the business world: You can work in a company’s finance or accounting department. You may try your hand at auditing. Auditing of tax returns. Maybe financial reporting is more your thing. Perhaps you’d want to work in money management. Or even financial planning. You might also deal with mergers! There are a lot of alternatives to pick from.

- Working in the banking industry: You may work in the financial sector by joining a bank. Forecasting, finance, and strategy, to name a few. This experience may also be used to break into the business sector.

- Working in the industry or for the government: You can work for a company or the government. Working as a business adviser entails developing, analysing, and reporting on data that is needed to make business choices.

- Working as a global accountant: You might choose to work in the field of financial reporting everywhere throughout the world. Scanning financial accounts of large MNCs might help you avoid or discover fraud. You might also work as a valuer, determining the worth of both assets and obligations.

- Working in the educational sector: You may work as a college or university instructor. You may even open your own educational institution!

- Higher education: If you want to work as a CA instructor or professor at a reputable academic institution, you can seek higher education.

Career Options after completing CMA (Cost and Management Accountant):

There is no shortage of jobs or career options for the CMA professional, and neither is there a lack of industries. Nearly every industry needs a CMA. Cost Accountants are always in high demand in the Public and Private sectors, Banking and Finance, Developmental Agencies, Education and Research, you name it! Some common job titles for CMA professionals include:

- Finance Manager

- Financial Analyst

- Financial Controller

- Chief Financial Officer (CFO)

- Certified Management Accountant

- Finance Director

- Senior Financial Analyst

- Chairman

- Managing Director

- Chief Executive Officer

These are only a few among the many job avenues you can seek employment in, as far as the private sector goes. In the government sector, you can be working in the all-India cadre – ICoAS which is the Indian Cost Accounts service and is as prestigious as the civil service posts of IAS, IPS and IFS. And if that’s not your cup of tea, you can always teach CMA by gaining the necessary academic qualifications.

Career Options after completing CS (Company Secretary):

There is no dearth in career options if you’ve completed all three of your CS courses. Almost every field and every company, big or small, requires a CS and you can understand more about what a CS is expected to do below:

A Company Secretary’s scope of work includes:

- Being a legal expert; a compliance officer and works only for that company.

- Being an expert in corporate laws, securities laws & capital market and corporate governance

- Being Chief Adviser to the board of directors on best practices in corporate governance

- Being responsible for all regulatory compliance of company

- Being the corporate planner and strategic manager for a company

To expand even further, these job profiles include the following:

Corporate Governance and Secretarial Services

- Corporate Governance Services

- Corporate Secretarial Services

- Secretarial/ Compliance Audit and certification Services

Corporate Laws Advisory and Representation Services

- Corporate Laws Advisory Services

- Representation Services

- Arbitration & Conciliation Services

Financial Market Services

- Public Issue, listing and Securities Management

- Takeover Code, Insider trading, Mergers & Amalgamation

- Securities Compliance and Certification Services

- Finance & Accounting Services

- Taxation Services

- International Trade & WTO Services

Management Services

- General/ Strategic Management

- Corporate Communication and Public Relations

- Human Resources Management

- Information Technology

Here is the above visualized in a nice flowchart:

If you wish to pursue higher studies in the field of CS, then teaching is also a viable and conducive option. The CS course from ICSI is recognized by the various renowned universities across India and overseas, if you’re looking for admission into a Ph.D course. It also provides utilization of services of members by various professional/educational bodies for academic pursuits. The ICSI conducts a Post-Membership Qualification (PMQ) Course in Corporate Governance as well.

Conclusion:

We hope we were able to provide some insight into the differences between the CA, CS, and CMA courses. Finally, we recommend that you go to the websites of the various courses to learn more about what you may expect when you enter the sector of your choice. Aside from that, you might talk to folks who have taken these courses or followed similar career opportunities to have a better idea of what to expect.

Better decide and give it your utmost!