These numbers (Your credit score) are one of the most crucial factors for your Potential lenders and creditors in deciding whether to offer you new credit. A credit score is a three-digit number representing your creditworthiness to potential lenders, including banks, financial institutes, or individuals. This number is designed to present your financial condition on how you will repay the loan on time to the lenders.

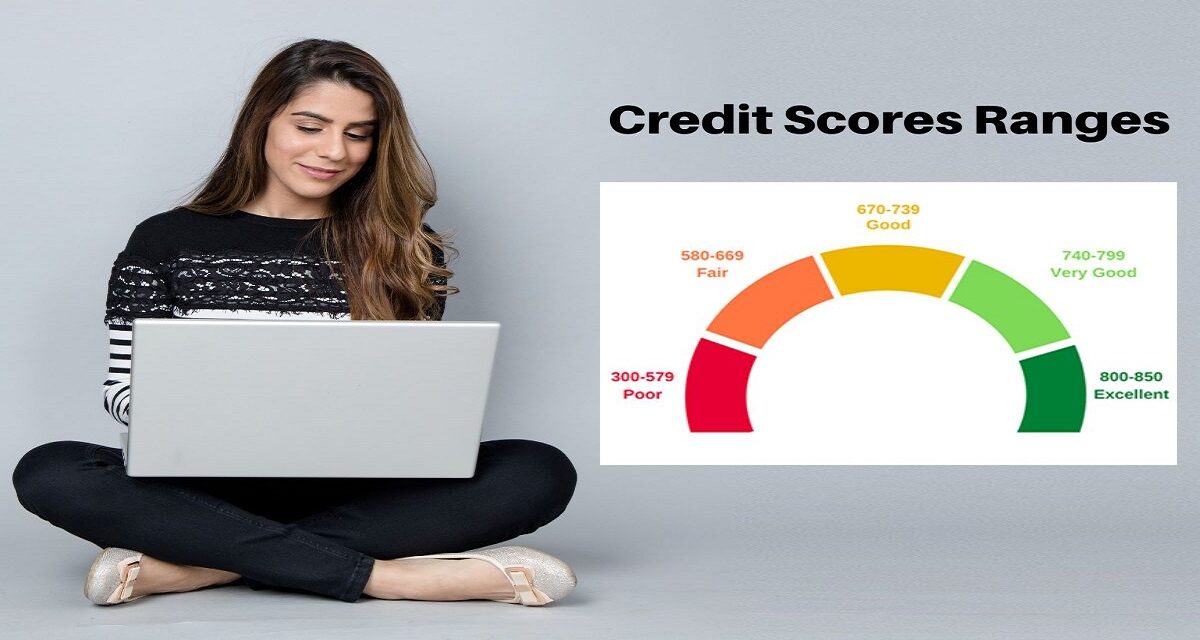

Credit scores are like a Credit solution for both lenders and borrowers as it serves both. Credit scores are also helpful for lenders to set the interest rates and other loan terms for the loan they will offer to any borrowers. The credit score usually ranges from 300 to 850; based on this range, credit score can be divided into the following five categories:

- Poor

- Fair

- Good

- Very good

- Excellent

What Are Credit Score Ranges?

- 800 to 850: Excellent

- 740 to 799: Very good

- 670 to 739: Good

- 580 to 669: Fair

- 300 to 579: Poor

What Does Credit Score Represent?

Various credit scoring models are available in the financial market, and each of these models calculates the credit score differently. However, most credit score ranges are similar to the following:

1. 300 to 579: Poor: People in the ranges will have difficulty getting loans from lenders. If they get loan approval, they often need to pay a high-interest rate for the loan. Before applying for any job, you need to improve your credit scores.

2. 580 to 669: Fair: People in this range group will also face difficulty getting loan approval because the Lenders may consider them higher-risk borrowers. These people have been known as subprime borrowers.

3. 670 to 739: Good: These people are lower-risk borrowers, and lenders can approve their loans after analyzing their pull credit report. There is a high chance their loan application gets selected.

4. 740 to 799: Very good: These people have an excellent credit behavior history. They are known to repay the loans on time, making it easier for lenders to approve loans.

5. 800 to 850: Excellent: These Individuals are considered low-risk borrowers. People in this range will secure a loan very quickly.

What Is A Good Credit Score?

There are no fixed numbers that guarantee your loan approval, interest rates, and terms. Most popular credit scoring models consider a minimum score of 670 reasonable. It tells the borrowers that they can consider loan applications. A higher credit score is more likely to appeal to lenders for loan approval. A Higher credit score is a symbol of responsible credit behavior in the past by an individual.

How Are Credit Scores Calculated?

A person’s credit score is calculated using the data available on the Agility Credit check. Many factors might influence your credit scores. Some of them are:

- Your payment history

- All Credit accounts information

- The length of your credit history

- The credit utilization rate

- Available credit limits

How To Build A Good Credit Score?

- Review your credit reports.

- Review your credit reports.

- Keep a tab on bill payments.

- Use less than 30% of available credit.

- Fewer applications for new credit.

- Prepare a thin credit file.

- Keep consolidating your debt.

- Track your progress with credit monitoring.