Section 80D Tax Deductions – Health Insurance Meets Tax Planning

Health insurance gives financial protection against unforeseen medical emergencies, covering hospitalization costs and all associated expenses. Healthcare expenses in India can be easily drained out of savings, leading to a huge financial burden and, in some cases, debt. By offering extensive tax benefits under Section 80D of the Income Tax Act of 1961, the government has enticed its residents to purchase health insurance coverage. This article goes through the provisions of Section 80D and allied deductions, helping taxpayers to maximize their savings.

What is Section 80D?

Section 80D allows individuals and Hindu Undivided Families (HUFs) to claim tax deductions on expenditures related to medical insurance premiums, contributions to health schemes, preventive health check-ups, and medical expenses for senior citizens. These deductions are supposed to ease the burden of medical costs on taxpayers and motivate them to seek their health and that of their families. Cash premium payments are not deductible.

Eligibility for Section 80D

Taxpayers, including individuals and Hindu Undivided Families (HUFs), can claim deductions under Section 80D. The eligible relationships include:

- Self

- Spouse

- Dependent children

- Parents

Eligible Payments Under Section 80D

Medical Insurance Premium Payments

Covers premiums paid for insuring:

- Self

- Spouse

- Dependent children

- Parents (dependent or independent)

Payments must be made using non-cash modes such as online banking, credit/debit cards, or cheques.

Support for the Central Government Health Program (CGHS)

Contributions towards the CGHS or similar schemes are eligible for deductions under the same limits as medical insurance premiums.

Preventive Health Check-Ups

Expenses for preventative health check-ups for self, spouse, dependent children, or parents can be deducted up to ₹5,000 under Section 80D restrictions.

Medical Expenses for Senior Citizens

If senior citizens (aged 60 or above) are uninsured, their medical expenses, including treatment and hospitalization, qualify for deductions.

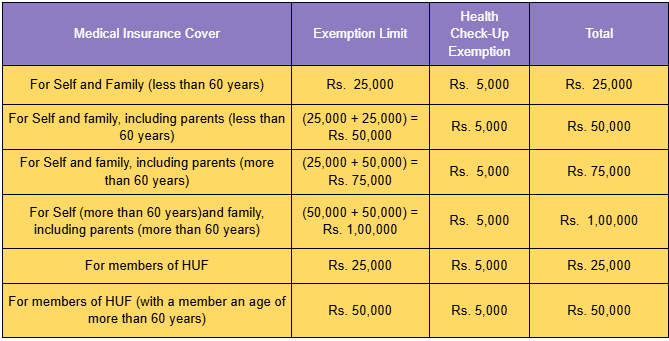

Deductions Available Under Section 80D

The deduction limits under Section 80D are based on the age of the insured individuals:

Individuals and Families Below 60 Years

- Maximum deduction: ₹25,000 (includes self, spouse, and dependent children).

Senior Citizen Families

- Maximum deduction: ₹50,000 (for individuals aged 60 or above).

Parents

- Below 60 years: ₹25,000.

- Senior citizens (60 years or above): ₹50,000.

Thus, the maximum deduction possible is ₹1,00,000, provided the taxpayer is elderly, as are their parents.

Deductions Under Section 80DD

In addition to Section 80D, taxpayers can claim deductions under Section 80DD for expenses related to the medical care of disabled dependents.

Deduction Limits

- Up to ₹75,000 for dependents with a disability.

- Up to ₹1,25,000 for dependents with a severe disability (80% or more).

Eligible Expenses

Includes medical treatment, nursing, rehabilitation, and training costs.

Proof Required

Taxpayers must submit medical certification issued by a government-authorized medical board when filing returns.

Deductions Under Section 80DDB

Section 80DDB provides tax deductions for expenses incurred on treating specified diseases for the taxpayer or their dependents.

Deduction Limits

- Up to ₹40,000 for individuals below 60 years.

- Up to ₹1,00,000 for senior citizens.

Specified Diseases

- Neurological conditions (40% disability or more): Dementia, Parkinson’s Disease, Ataxia, Aphasia, Hemiballismus, and others.

- Malignant Cancer.

- AIDS (Acquired Immunodeficiency Syndrome).

- Chronic Renal Failure.

- Hematological disorders like Hemophilia or Thalassemia.

Eligibility

Covers medical expenses for the taxpayer’s spouse, parents, children, and siblings.

Proof Required

Certification from a specialist doctor and proof of treatment are required to claim deductions.

Section 80D vs. Section 80C

Taxpayers often get confused between Section 80D and Section 80C. Though both sections offer tax benefits, they serve different purposes for financial instruments:

Section 80D

It only deals with health-related expenses like medical insurance and preventive check-ups.

Section 80C

It covers a wider range of investments, including Public Provident Fund (PPF), National Savings Certificate (NSC), tax-saving fixed deposits, and life insurance premiums.

This will make the taxpayer more efficient in their planning of finance.

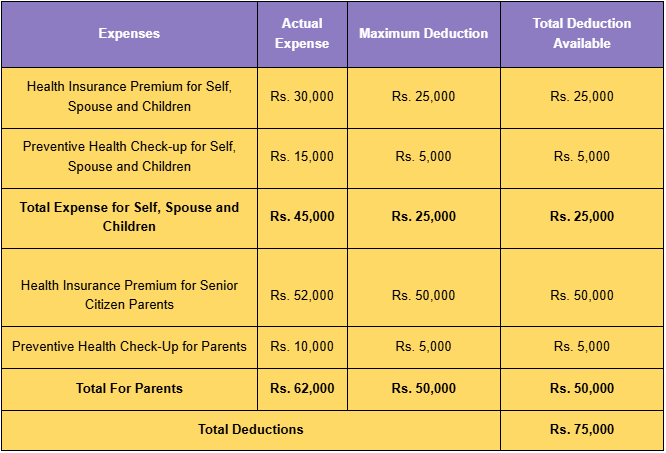

For Instance, Deductions Under Section 80D

Assume that there is an individual named Ajay, who is 35 years old.

Ajay has a family of six: himself, his wife (34), two children (11 and 7), his father (63), and his mother (59).

He purchased a health insurance policy covering his family, paying a premium of ₹30,000.

Additionally, he paid ₹52,000 for his parents’ health insurance.

Ajay also spent ₹15,000 on his family’s preventive health check-ups and ₹10,000 on his parents’ check-ups.

Total Expenses

₹1,07,000 (₹30,000 + ₹52,000 + ₹15,000 + ₹10,000).

Example –

Claimable Deduction

Ajay can claim the following deductions:

- ₹25,000 for himself, his spouse, and his children (below 60 years).

- ₹50,000 for his senior citizen father.

Despite incurring ₹1,07,000, Ajay’s deduction is capped at ₹75,000 per the limits under Section 80D.

Conclusion

Section 80D helps taxpayers save on medical costs and reduce their tax outgo. If one understands the provisions and related sections, families and individuals can protect themselves from the rising health cost burden. Taxpayers need to keep all relevant documents, including receipts of insurance, medical certificates, and proof of payment, handy to claim deductions while filing returns without any hassle.

This proactive approach for health and financial management benefits the individual and society at large, hence the raised awareness of health insurance in India.