Any analytical application used in pharmaceutical and medical device firms, clinical research organizations, and many divisions, such as supply chain, research, pharmacovigilance, marketing, and others, is referred to as life sciences analytics.

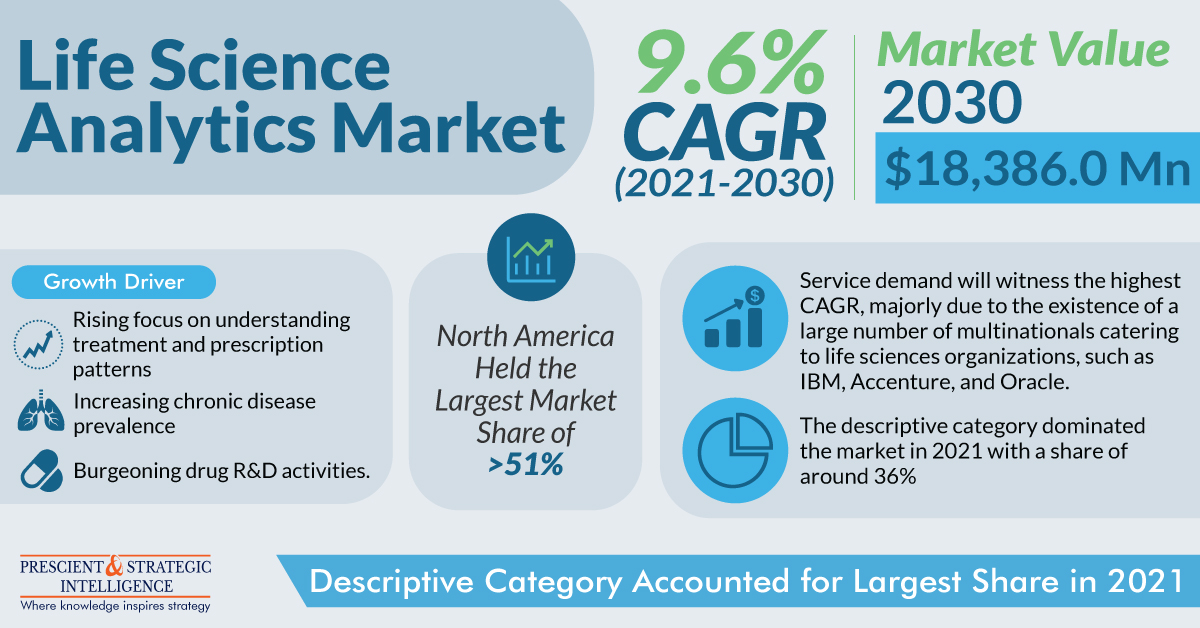

The life science analytics market is set to touch $ 18,386.0 million value by 2030. The need for these solutions is primarily driven by the growing significance of early illness diagnosis through the analysis of current data, which may aid in comprehending prescription and treatment trends throughout the patient’s healthcare journey and attaining operational excellence.

Largest Share Belongs to the Descriptive Category

Due to descriptive analytics’ capacity to spot trends and connections in current and historical data, the descriptive category now holds a market share of about 36%. It describes patterns and associations, making it the simplest data analysis type.

Over the projection period, it is expected that the volume of patient data will increase, function-specific analytics software will become more widely available, and the need for cloud-based life sciences services will increase.

Big data and analytics have been widely adopted by major healthcare, pharmaceutical, and medical device firms, which is one of the important factors that may be attributed to the greatest market share of this category.

Given that businesses are using business intelligence solutions that can help them adopt a more flexible approach to their operations, predictive analytics is the second-largest stakeholder in the market.

This is taken into account in light of the life sciences industry’s multiple difficulties while negotiating healthcare reforms, providing value and innovation, and enhancing supply chains.

Continuous Investments to Strengthen Healthcare in APAC

Future life science analytics industry growth will be at 9.9% in APAC, which will be the highest. In the future, growth in Asia will be fueled by an increase in chronic illnesses, a booming life sciences sector, widespread use of new technologies, and other factors.

Healthcare IT spending has increased due to several causes, including infrastructure upgrades, new participants in the market, and a rise in population digital literacy.

How Can R&D Contribute to Growth Acceleration?

Pharma firms can find new medications with a high chance of success in the R&D and clinical research phases by mining the enormous volumes of data produced during these procedures.

With established systems for data collecting and analytical tools, contract research businesses often provide real-time analysis and warnings for each department regarding the safety or efficacy of medications or clinical studies.

The Pharmaceuticals Sector Predominates

The pharmaceutical sector led all other sectors with a market share of over 47%. This is attributed to the transition from conventional approaches to cutting-edge technologies for diagnosing illnesses, creating game-changing products, and addressing how therapies affect patient outcomes.

Life science analytics is essential in this situation because it offers accurate, on-demand client interaction solutions and data-driven business models.

Technological Advancements

Over the past several years, pharmaceutical firms have begun to view digitization more and more as a strategic effort that can convert various parts of the value chain into something more productive and lucrative.

Digital technologies like mobility and pervasive computing, big data, and analytics may help businesses increase their R&D efficiency, sales, and marketing effectiveness, manufacturing capabilities, and compliance management.