If you need to check-in in MSME/udyam, You are at the best place. We are a Service provider with a team of fantastically skilled. Apply Online MSME/ Udyam Registration Portal for Service and Manufacturing section. This scheme is to offer micro, small, and medium commercial enterprise proprietors with the most benefits from the Indian authorities. Udyam is the spine of the Indian economy. It offers our corporations the essential resiliency withinside the face of world adversity.

Micro, Small, and Medium Enterprises (MSME) is an abbreviation for Micro, Small, and Medium Enterprises. The MSME Act, which aims to support the promotion, growth, and betterment of the globalization of micro, small, and medium firms, governs MSMEs. Although the MSME Act does not necessitate registration, many business units do so in order to provide access to perks such as financing, loans, and cooperation in government tenders for MSMEs. The Act allows both manufacturing and service industries to register.

1. What is an MSME?

The Micro, Small, and Medium Enterprises Improvement (MSMED) Act of 2006 was used by the Indian government to promote MSME, or Micro, Small, and Medium Enterprises. The development, manufacturing and marketing, processing, or preservation of goods and products is the primary focus of these businesses.

MSMEs are classified into four categories in accordance with Notification No. S.O. 1702(E) Dated 01.06.2020, effective July 01, 2020.

| Criteria | Micro | Small | Medium |

| Plant and machinery purchases | Not more than Rs.1 crore | Not more than Rs. 10 crore | Not more than Rs. 50 crore |

| Turnover on an annual basis | Not more than Rs.5 crore | Not more than Rs.50 crore | Not more than Rs.250 crore |

2. How do you figure out how much your plant and machinery are worth?

The government explained in an official statement August 6, 2020 that the value of property and equipment or materials has the same meaning as tools and equipment in the Income Tax Rules, 1962, adopted under the Internal Revenue Code, 1961, and includes all financial assets (other than land and building, furniture and fittings).

The online Udyam Registration Form records depreciated costs as of the 31st March of the previous year. As a result, for all people’s benefit of Notification No. S.O. 2119(E) dated 26.6.2020 and for all businesses, the value of Equipment and Machinery or Equipment shall be the Written Down Value (WDV) as of the end of the Financial Year as described in the Company Act, rather than the cost of acquisition or original price, which was applicable in the context of the previous classification systems.

3. Documents is Required

- Before beginning the application process on the MSME portal, keep the following papers on hand:

- Aadhar is an id number (mandatory)

- PAN

- For the purposes of calculating turnover and investment, the most recent balance sheet are to be used.

- Certificate of Incorporation (Certificate of Incorporation) (in case of Company)

- Certificate of the finish of a firm

- The total percentage of employees is listed, together with a gender breakdown.

4. The Benefits of MSME Registration

Despite the fact that there is no legal basis for the registration. Businesses typically register in order to be granted benefits, incentives, or promotions from the federal or state governments under the MSMED Act. The registration of micro, small, and medium (MSM) firms under the MSMED Act is a very effective technique for taking advantage of the Centre’s reward system, which normally includes the following:

- Buyers’ payment delays are shielded, as are interest rights on delayed payments.

- Conciliation and arbitration are used to settle conflicts with purchasers in a timely manner.

- MSMED Act, MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES, GOVERNMENT OF INDIA, is used to register businesses.

- Banks offer additional easy fiance without the need for security.

- Lower interest rates, and maybe even better loan opportunities and access:

- In government projects, there is a preference.

- ISO certification insurance Expenses/subsidies associated with ISO certification, patents, and trademarks.

- Reservation policies to fabrication sector firms must be registered with the Small Industries Development Corporation (NSIC).

- Cooperation in government registration purchases.

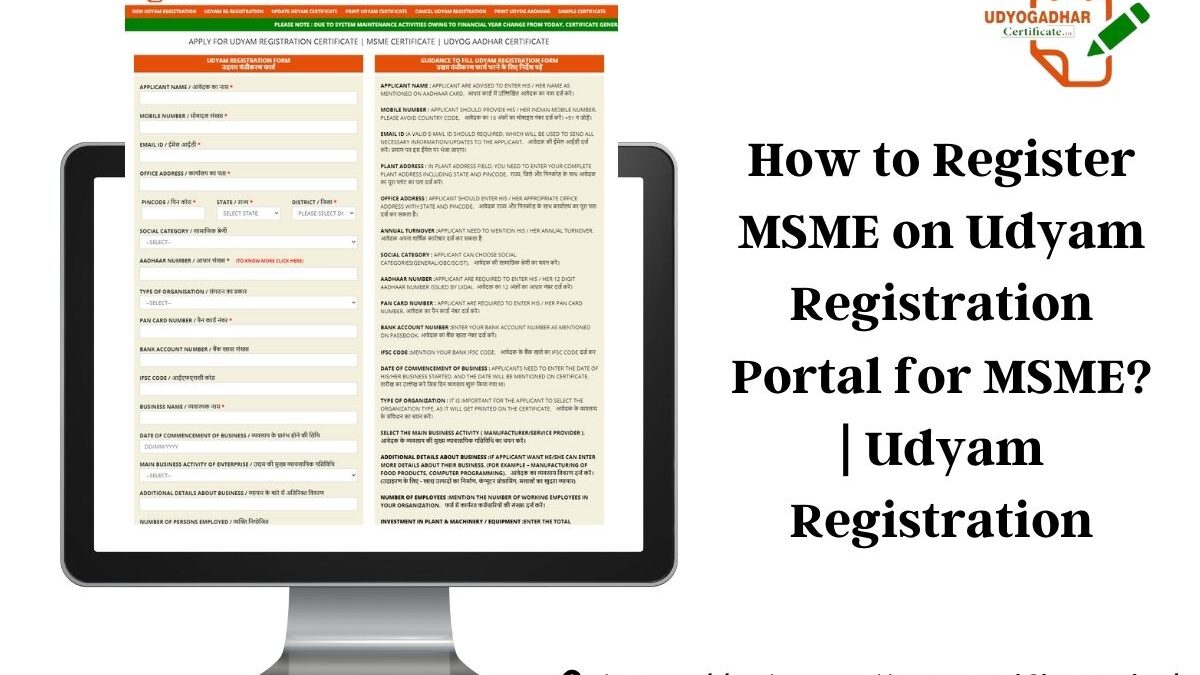

5. MSME Registration Procedures

The registration procedure is simple and direct.. An applicant can directly submit an online application using an Aadhar number through the MSME portal

The registration procedure is separated into two phases:

1.1 New Registration: If you’re a new entrepreneur who hasn’t yet registered as an MSME,

Those that don’t have a UDYOG Aadhar (UAM) or an EM-II must apply for new registration. New applicants must visit the MSME portal to register for the first time given the link above.

1.2 Migration: For entrepreneurs who have already completed the EM-II or UAM registration process.

By way of an official statement on August 5, 2020, the government stated that local companies registered prior to June 20, 2020, will be valid only until March 31, 2021, and as a result, the government exhausted that all current EM part II and UAMs would become valid until June 30, 2020.

Also, Read about Udyam Verification

Conclusion

Udyam registration is the best place to register for proprietors, entrepreneurs, and business startups to get classified under MSMEs after registration anyone can enjoy all the benefits offered by the ministry of MSME and special allotment in government tender. They can also take advantage of various forms of subsidies and bank low-interest rates. So get registered in udyam registration to build your own name in the business field.