tep by step instructions to Ascertain Present Worth Interest Component of Annuity (PVIFA)

Blog Presentation: The current worth interest component of an annuity (PVIFA) is a monetary idea used to work out the current worth of a flood of equivalent installments.

The installments can be made at customary stretches, like month to month or yearly, for a predefined timeframe. The computation for PVIFA calculator takes into account the time worth of cash, which says that a dollar today is valued at in excess of a dollar later on.

Instructions to Work out PVIFA

To compute PVIFA, you’ll have to realize the loan fee, number of periods, and present worth. Loan fee is normally given as a rate.

Number of periods is the complete number of installments you’ll make. For instance, assuming that you’re making regularly scheduled installments for quite some time, you have 60 periods. Present worth is the singular amount sum you right now have.

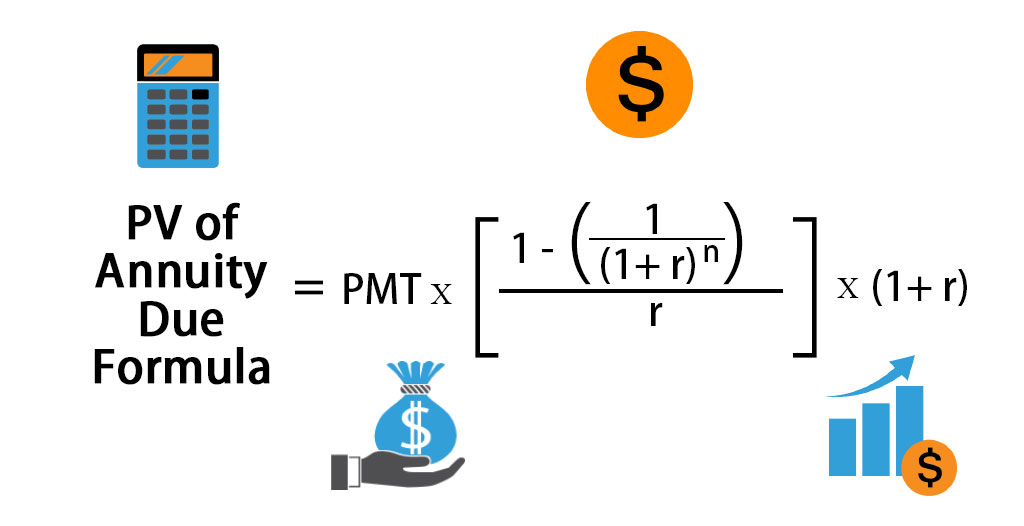

When you have those qualities, plug them into this equation:

PVIFA = (1 – (1/(1 + i)^n))/I

I = loan cost

n = number of periods

For instance, suppose you’re making yearly installments for a long time at a 5% loan fee, and the current worth is $1,000. Utilizing the equation above, we get:

PVIFA = (1 – (1/(1 + .05)^10))/.05

PVIFA = 9.5489

This implies that every installment you make over the existence of the annuity will be valued at $9.55 today. Knowing how to compute PVIFA can assist you with figuring out the genuine expense of applying for a line of credit or making a venture.

The PVIFA equation might look overwhelming from the start, however it’s really not excessively hard to work out once you understand what every variable addresses.

What’s more, understanding how to work out PVIFA can be useful in pursuing monetary choices like applying for a new line of credit or putting resources into an annuity.

RFM Examination – What is it and How to Involve it in Computerized Showcasing?

Blog Presentation: On the off chance that you’ve been associated with computerized promoting for any timeframe, you’ve without a doubt gone over the expression “RFM.”

Yet what precisely is it?

RFM means “recency, recurrence, and financial worth,” and it’s a proven technique for surveying client conduct. It’s additionally a unimaginably helpful instrument for creating designated showcasing efforts. Here is a concise outline of RFM examination and how you can utilize it to further develop your showcasing endeavors.

What is RFM?

RFM is a client division method that surveys three critical bits of client information: recency (how as of late they made a buy), recurrence (how frequently they make buys), and money related esteem (the amount they spend per buy).

This data can then be utilized to make designated promoting efforts that are intended to urge clients to either purchase all the more oftentimes, purchase more costly things, or both.

The most effective method to Involve RFM in Computerized Promoting

There are perhaps a couple ways of involving RFM information in your computerized showcasing efforts. One is to make fragments in light of client conduct.

For instance, you could make a fragment for clients who have made a buy inside the previous week (high recency), have made something like three buys in the previous month (high recurrence), and have spent a normal of $50 per buy (high financial worth).

You can then focus on this section with advertisements and messages that feature unique arrangements and offers.

One more method for utilizing RFM information is to score every client in view of their recency, recurrence, and money related esteem. The scoring should be possible on a size of 1-5, with 5 being the most noteworthy.

Clients who score high in every one of the three classifications would be viewed as your “best” clients, while the people who score low would be thought of as your “most exceedingly terrible.

You can then focus on your best clients with devotion programs and different impetuses intended to make them want more. Simultaneously, you can focus on your most terrible clients with promotions and messages featuring the advantages of improving as a client.

RFM calculator is a strong client division method that each computerized advertiser ought to be know about. By understanding how RFM functions and how to involve it in your advertising efforts, you can urge clients to purchase all the more as often as possible, spend more per buy, or both. Take a stab at involving RFM examination in your next mission and perceive how it functions for you!