With many banking apps and UPI services, online payment has become a preferred, hassle-free mode of payment for many.

And digital savings accounts offered by most banks only take this benefit a step further. Since your savings account and debit cards are linked with various payment apps, it makes it even easier to spend money on the things you love.

However, transferring funds online isn’t as simple as it seems. There are many ways to do so, and you might be charged extra on certain transactions. Here’s everything you need to know.

1. Online Banking

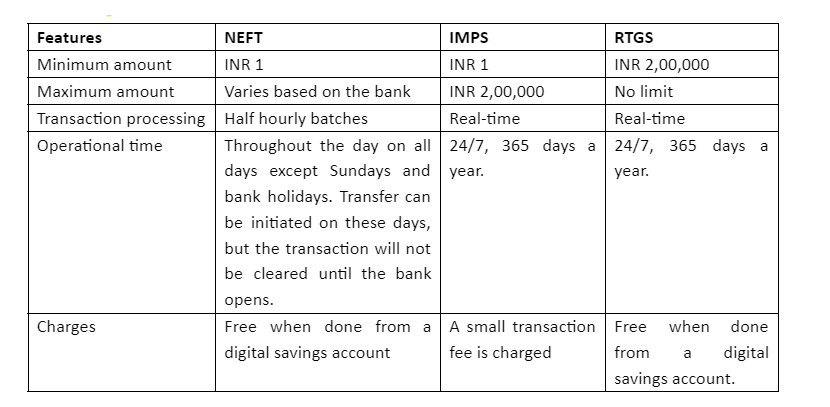

With its multi-step verification, online banking is one of the most secure methods of transferring funds to another account. Online banking is a broad term comprising three main fund transfer types: NEFT, RTGS, and IMPS.

All three methods allow you to transfer money from one bank account to another using a bank account number and IFSC code. Let us look at the salient features of each method:

2. UPI

UPI is the latest and most convenient method of payment that requires only the bank account-linked mobile number or the UPI ID for the transaction. You can use a UPI payment app to pay bills, both online and offline merchants, at the grocery store, and more. Moreover, UPI payments are free of charge for a digital savings account.

3. Debit Card

A virtual debit card can be used to carry out commercial transactions online, just like a regular debit card. Usage of the debit card attracts no charges but provides many benefits and discounts with specific merchants.

To Sum Up

Adopting digital payments is not just convenient but also more secure and beneficial. Opening a digital savings account with IndusInd Bank can give you an extra edge because you save on many transaction charges and get amazing added benefits such as cashback or rewards points on online debit card transactions.

So, if you’re one to make frequent digital payments, open a digital account with IndusInd Bank today to make the most of your transactions.