In the intricate world of business and finance, accountants play a pivotal role in maintaining order and ensuring that financial transactions are accurately recorded, analyzed, and reported. Their expertise spans various domains, from bookkeeping to tax preparation. This article delves into the responsibilities, skills, and significance of accountants in today’s dynamic business environment.

The Evolution of Accounting

Early Record-Keeping

Accounting’s origins date back to ancient civilizations like Mesopotamia and Egypt, where people used basic methods to record agricultural production and trade transactions. These rudimentary forms of accounting laid the groundwork for modern financial practices.

From Ledger Books to Digital Revolution

The Industrial Revolution marked a turning point as businesses expanded, necessitating more complex accounting systems. The 20th century saw the rise of computerized accounting, enhancing accuracy and efficiency. Today, cloud-based solutions and automation streamline financial processes, allowing accountants to focus on strategic decision-making.

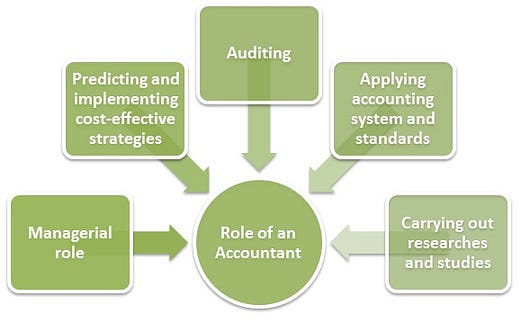

The Key Responsibilities of Accountants

1. Financial Recording and Bookkeeping

At its core, accounting involves systematically recording financial transactions, maintaining ledgers, and ensuring accuracy in financial data. Accountants organize and classify expenses, revenues, and assets, providing a foundation for informed business choices.

2. Financial Analysis and Reporting

Accountants don’t just crunch numbers; they interpret them. They analyze financial statements, identifying trends, strengths, and areas for improvement. Their insights guide stakeholders in making sound financial decisions.

3. Tax Planning and Compliance

Navigating the labyrinthine world of taxation is another vital role of accountants. They stay updated with tax laws, minimize tax liabilities, and ensure compliance, avoiding legal repercussions.

4. Auditing and Assurance

Accountants conduct audits to verify the accuracy of financial records and processes. This independent assessment provides confidence to stakeholders, such as investors and regulators.

Skills Every Accountant Should Possess

1. Attention to Detail

The devil is in the details, and accountants know this all too well. Precision is crucial to avoid errors that could lead to financial mismanagement.

2. Analytical Acumen

Accountants need to interpret complex financial data, requiring strong analytical skills. They unearth valuable insights that drive business growth.

3. Tech Savviness

In the digital age, proficiency in accounting software and technology is essential. Accountants must adapt to new tools that enhance efficiency and accuracy.

The Significance of Accountants in Business

Accountants are the financial backbone of any organization. Their insights help company leaders make informed decisions, allocate resources effectively, and mitigate risks. In startups, they ensure financial stability, while in established firms, they drive growth strategies.

The Human Touch in a Digitized World

Despite automation, the human element in accounting remains vital. Accountants offer personalized financial guidance, empathetically understanding their clients’ goals and challenges.

Conclusion

In a world driven by numbers, accountants bring clarity and order. From recording transactions to guiding major financial decisions, their expertise is invaluable. As technology evolves, so does the accountant’s role, but their core function of financial stewardship remains unchanged.

FAQs About Accountants

What qualifications do accountants typically hold?

Accountants often possess a degree in accounting or finance. Many also pursue certifications like CPA (Certified Public Accountant) for added expertise.

How do accountants stay updated with tax laws?

Accountants attend seminars, workshops, and online courses to stay abreast of constantly evolving tax regulations.

What industries do accountants work in?

Accountants are needed in virtually every industry, from healthcare to entertainment, as financial management is essential across the board.

Can small businesses benefit from hiring accountants?

Absolutely. Small businesses can gain valuable insights from accountants to manage expenses, plan for growth, and maximize profits.

Are accountants solely focused on numbers?

While numbers are at the core of their work, accountants also provide strategic advice, helping businesses achieve their financial objectives.