Introduction to Working Capital;

Working capital is a vital aspect of every business, regardless of its size or industry. It refers to the amount of liquid assets that a company has available to cover its daily operations and financial obligations. These can include expenses such as rent, payroll, inventory purchases, and other short-term liabilities.

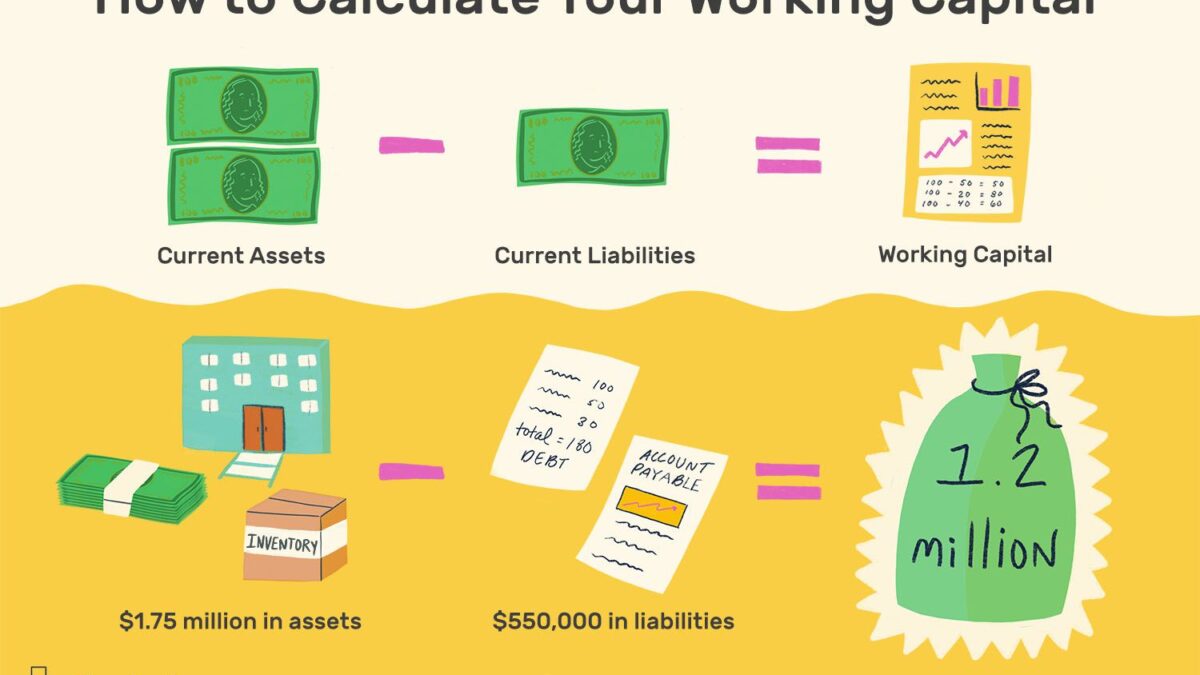

In simpler terms, working capital is the difference between a company’s current assets (cash and other assets that can be easily converted into cash) and its current liabilities (debts and obligations due within a year). Essentially, it shows how much money a company has left after paying off its short-term debts.

Having an adequate amount of working capital is crucial for businesses to maintain their day-to-day operations smoothly. If a company lacks sufficient working capital, it may struggle to pay its bills on time, leading to late fees or even defaulting on loans. On the other hand, excess working capital can also be harmful as it indicates that the company is not investing in growth opportunities or utilising its resources efficiently.

Importance of Calculating and Managing Working Capital;

Working capital is a crucial aspect of a company’s financial health that often gets overlooked or underestimated. It refers to the amount of cash and current assets available to cover day-to-day operations and expenses. Calculating and managing working capital is essential for businesses of all sizes, as it can directly impact their profitability, liquidity, and overall stability.

One of the main reasons why calculating working capital is important is that it gives businesses an accurate understanding of their financial standing. By subtracting current liabilities from current assets, companies can determine how much cash they have readily available to meet short-term obligations. This figure provides valuable insights into a company’s ability to manage its daily operations without relying on external sources of funding.

Moreover, calculating working capital can also help businesses identify potential areas for improvement in their financial management. For instance, if a company has a significant amount tied up in inventory or accounts receivable, it may indicate inefficiencies in their supply chain or collection processes. By closely monitoring these figures, companies can take proactive measures to optimise their cash flow and improve their overall working capital position.

Understanding the Components of Working Capital;

Working capital is a crucial aspect of financial management for any business, as it represents the funds available for day-to-day operations and growth. It is essentially the difference between a company’s current assets and liabilities, and serves as an indicator of its short-term financial health. In order to effectively manage working capital, it is important to understand its components and how they impact the overall financial stability of a business.

- The two main components of working capital are current assets and current liabilities. Current assets include cash, accounts receivable, inventory, and other assets that can be easily converted into cash within one year. These assets provide short-term liquidity for a company and are essential for meeting daily operational expenses.

- On the other hand, current liabilities refer to the debts or obligations that a company must repay within one year. This includes accounts payable, accrued expenses, taxes due shortly, and other short-term debts. These liabilities represent the funding sources used by a company to finance its operations.

To better understand how these components affect working capital, let’s look at an example: Company A has $50,000 in cash (current asset) and $30,000 in accounts payable (current liability). The working capital would be calculated as follows:

How to Calculate Working Capital Ratio?

Working capital is a crucial financial metric for any business. It represents the amount of liquid assets a company has to cover its short-term financial obligations, such as paying bills and purchasing inventory. A higher working capital ratio indicates that a company is in a better position to meet its short-term financial commitments, while a lower ratio may suggest potential cash flow problems.

Calculating the working capital ratio is relatively simple, but it requires accurate information about a company’s current assets and liabilities. The formula for calculating the working capital ratio is:

Working Capital Ratio = Current Assets / Current Liabilities

Current assets include cash, accounts receivable, inventory, and other assets that can be easily converted into cash within one year. On the other hand, current liabilities include accounts payable, short-term loans, and other debts that are due within one year.

Let’s look at an example to understand this better. Suppose Company XYZ has current assets worth $500,000 and current liabilities of $300,000. Their working capital ratio would be calculated as follows:

Working Capital Ratio = $500,000 / $300,000 = 1.67

This means that for every dollar of current liabilities, Company XYZ has $1.67 of current assets available to cover them. Generally speaking, a good working capital ratio is considered to be between 1.2 and 2.

A high working capital ratio may indicate that a company has excess liquidity or may not be utilising its resources efficiently. On the other hand, if the working capital ratio is too low (less than 1), it could signify that the company may have trouble meeting its immediate financial obligations.

By calculating and managing your company’s working capital effectively, you can ensure that you have enough resources to meet short-term financial obligations and maintain a healthy cash flow. Remember, having a good working capital ratio is essential for the long-term success of any business.

Tips for Managing and Improving Working Capital;

Managing and improving working capital is crucial for every business, regardless of its size or industry. Working capital refers to the difference between a company’s current assets and liabilities, representing the funds available for daily operations. It is a measure of a company’s short-term financial health and its ability to meet its short-term obligations.

Here are some tips for managing and improving your company’s working capital:

- Forecast cash flow: The key to effective working capital management is accurate cash flow forecasting. This involves predicting the inflow and outflow of cash over a specific period. By doing so, businesses can identify potential cash shortages or surpluses in advance and take necessary actions to manage them.

- Reduce inventory levels: Inventory ties up a significant amount of working capital in most businesses. Therefore, it is essential to keep inventory levels lean by accurately forecasting demand and having efficient inventory management systems in place. This will help prevent excess stock that may lead to unnecessary costs.

- Monitor accounts receivable: Late payments from customers can severely affect a company’s working capital position. To avoid this, it is crucial to have strict credit policies in place that outline payment terms clearly and follow up on overdue invoices promptly.

- Manage accounts payable: Just like monitoring accounts receivable, keeping track of accounts payable is equally important for managing working capital effectively. Negotiating favourable payment terms with vendors can help delay cash outflows without affecting relationships.

- Optimise supplier relationships: Building strong relationships with suppliers can lead to better payment terms, discounts, and improved supply chain efficiency – all of which contribute positively towards managing working capital.

Effective management of working capital is crucial for the long-term success of any business. By following these tips, businesses can optimise their cash flow, maintain adequate liquidity, and ensure smooth operations. Remember, managing working capital is an ongoing process that requires constant evaluation and adjustments to suit the changing needs of the business.

Tools and Resources for Tracking and Analysing Working Capital;

When it comes to effectively managing and optimising your company’s working capital, having access to the right tools and resources can make all the difference. In this section, we will discuss some useful tools and resources that can help you track and analyse your working capital.

- Investing in a reliable accounting software can greatly simplify the process of tracking your company’s working capital. These software programs offer features such as cash flow management, accounts receivable and payable tracking, inventory management, and budgeting tools. With real-time data updates and customizable reports, accounting software makes it easy to monitor your company’s financial health.

- A working capital ratio calculator is a handy tool that helps you determine whether your company has enough current assets to cover its short-term liabilities. This ratio is calculated by dividing current assets by current liabilities, giving you a percentage that indicates your company’s liquidity position. There are several free online calculators available that you can use to monitor changes in your working capital ratio over time.

- Tracking cash flow is crucial for effective working capital management. Cash flow forecasting tools help you predict future cash inflows and outflows based on past trends and upcoming expenses or sales projections. By identifying potential cash shortages in advance, these tools allow you to take proactive measures to avoid any disruptions in operations.

- For businesses with high levels of inventory, efficient inventory management is essential for optimising working capital. Inventory management systems help track inventory levels, reorder points, lead times, and other key metrics that directly impact your company’s cash flow.

- There are various financial analysis platforms available that provide valuable insights into your company’s financial performance compared with industry benchmarks or competitors’ data. These platforms use advanced analytics techniques to identify areas for improvement in terms of efficiency, profitability, liquidity ratios or debt levels.

- Treasury management solutions offer comprehensive cash flow management and forecasting tools, along with features such as automated payments, cash pooling, and risk management. These systems integrate with your accounting software to provide a centralised view of all your financial data and streamline cash management processes.

Using these tools and resources can help you gain a better understanding of your company’s working capital trends and make informed decisions to optimise it. It is essential to regularly track and analyse your working capital to maintain healthy levels that support the day-to-day operations of your business.

Conclusion;

In conclusion, proper management of working capital is essential for the success and stability of any business. By following these steps to calculate and monitor your company’s working capital, you can make informed decisions about your finances and ensure that your operations run smoothly. Remember to regularly review and adjust your strategy as needed to maintain a healthy level of working capital. With a thorough understanding of this financial concept, you can set your company up for long-term success.