Mobile apps have revolutionized the way people manage their finances, offering convenience, accessibility, and efficiency. In the finance industry, mobile apps have become essential tools for both consumers and businesses, providing a range of services from banking to investment management. This article explores the evolution of mobile apps in finance, their benefits, key features, security concerns, future trends, and case studies showcasing their impact.

Statistics

According to Statista, the global mobile banking user base is projected to reach 1.6 billion by 2023, up from 0.8 billion in 2019. This rapid growth is fueled by the increasing adoption of smartphones and the convenience of mobile banking. Additionally, a survey by PwC found that 46% of consumers use mobile apps for financial services at least once a week, highlighting the importance of mobile apps in the finance industry.

Evolution of Mobile Apps in Finance

Mobile apps in the finance industry have evolved significantly since their inception. Initially, mobile banking apps offered basic services such as checking account balances and transferring funds. However, as technology advanced, so did the capabilities of these apps.

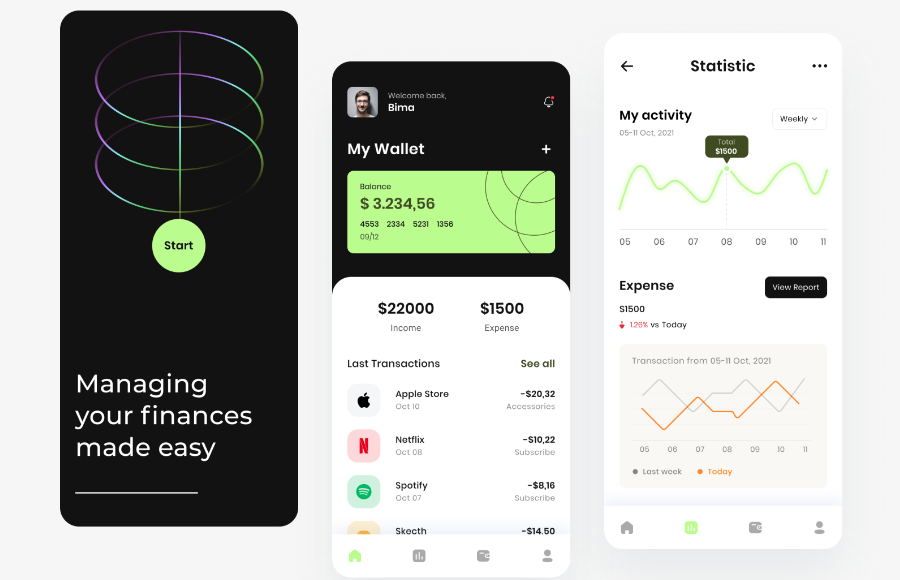

Today, finance mobile apps offer a wide range of features, including:

Account Management: Users can view account balances, transaction history, and manage multiple accounts from a single app.

Payments and Transfers: Mobile apps allow users to pay bills, transfer money between accounts, and send money to friends and family using mobile wallets or peer-to-peer payment services.

Budgeting and Financial Planning: Many finance apps offer budgeting tools, expense tracking, and financial planning advice to help users manage their money effectively.

Investment Management: Mobile apps enable users to buy and sell stocks, mutual funds, and other investments, as well as access real-time market data and investment research.

Loan and Credit Card Management: Users can apply for loans, manage their credit cards, and track their credit scores through mobile apps.

Benefits of Mobile Apps in Finance

Mobile apps offer several benefits to both consumers and businesses in the finance industry:

Convenience: Mobile apps allow users to access their financial information anytime, anywhere, making it easier to manage their money on the go.

Accessibility: Mobile apps make financial services more accessible to underserved populations, such as those in rural or remote areas.

Cost Savings: Mobile apps can help businesses save money by reducing the need for physical branches and paper-based transactions.

Personalization: Mobile apps can offer personalized financial advice and recommendations based on users’ spending habits and financial goals.

Efficiency: Mobile apps streamline financial processes, such as payments and transfers, saving users time and effort.

Development Process of Finance Mobile App

Developing a finance mobile app involves several key stages, from conceptualization to deployment. Here is an overview of the development process:

- Conceptualization and Planning:

- Define the app’s purpose, target audience, and key features.

- Conduct market research to understand user needs and competition.

- Create a detailed project plan, including timelines, budget, and resource allocation.

- Design:

- Create wireframes and prototypes to visualize the app’s layout and user flow.

- Design the UI/UX user interface and user experience to ensure a seamless and intuitive user experience.

- Develop a design system to maintain consistency across the app.

- Development:

- Choose the appropriate technology stack based on the app’s requirements (e.g., programming languages, frameworks, databases).

- Find a Trusted Fintech app development company to build your fitness app.

- Develop the front-end of the app, including UI components and navigation.

- Implement the back-end infrastructure, including servers, databases, and APIs.

- Integrate third-party services, such as payment gateways and analytics tools.

- Testing:

- Conduct thorough testing to ensure the app functions as intended and is free of bugs and errors.

- Perform user acceptance testing (UAT) to gather feedback from real users and make necessary improvements.

- Security and Compliance:

- Implement security measures, such as encryption and secure authentication, to protect user data.

- Ensure compliance with relevant regulations, such as GDPR or PCI DSS, to protect user privacy and data security.

- Deployment:

- Deploy the app to the appropriate app stores (e.g., Apple App Store, Google Play Store) for distribution.

- Monitor the app’s performance and user feedback after deployment.

- Maintenance and Updates:

- Provide regular updates to fix bugs, add new features, and improve performance.

- Monitor user feedback and analytics to identify areas for improvement and optimize the app accordingly.

- Support:

- Offer customer support to address user queries, issues, and feedback.

- Provide user training and documentation to help users make the most of the app’s features.

Find development partners: Top Fintech App Development Companies in 2024

Key Features of Finance Mobile Apps

Finance mobile apps offer a variety of features to enhance the user experience and provide valuable financial services. Some key features include:

Biometric Authentication: To ensure security, many finance apps use biometric authentication, such as fingerprint or face recognition, to verify users’ identities.

Alerts and Notifications: Finance apps can send alerts and notifications to users about upcoming bill payments, low account balances, or suspicious activity.

Customer Support: Many finance apps offer customer support through chat, phone, or email to assist users with any issues they may encounter.

Personal Finance Management Tools: Finance apps often include tools for budgeting, expense tracking, and goal setting to help users manage their finances effectively.

Integration with Other Financial Services: Some finance apps can integrate with other financial services, such as insurance or investment accounts, to provide a comprehensive financial management solution.

Security and Privacy Concerns

Despite the benefits of mobile apps in finance, security and privacy concerns remain a major issue. With the increasing use of mobile devices for financial transactions, hackers are targeting mobile apps to steal sensitive information. To mitigate these risks, finance apps should implement strong security measures, such as encryption, multi-factor authentication, and regular security audits.

Future Trends in Finance Mobile Apps

The future of finance mobile apps looks promising, with several key trends expected to shape the industry:

- Artificial Intelligence and Machine Learning: AI and ML technologies will enable finance apps to offer more personalized services, such as tailored financial advice and predictive analytics.

- Blockchain and Cryptocurrencies: Finance apps may integrate blockchain technology to provide secure and transparent transactions, as well as support for cryptocurrencies.

- Open Banking: Open banking initiatives will enable finance apps to integrate with third-party financial services, providing users with more choices and better financial management tools.

- Enhanced Security Measures: Finance apps will continue to invest in enhanced security measures to protect users’ sensitive information from cyber threats.

- Augmented Reality and Virtual Reality: AR and VR technologies may be used to enhance the user experience of finance apps, such as providing virtual financial planning sessions or interactive investment simulations.

Case Studies

- Bank of America: Bank of America’s mobile app offers a wide range of features, including mobile check deposit, bill pay, and budgeting tools. The app has been instrumental in driving customer engagement and satisfaction, with over 40 million active users.

- PayPal: PayPal’s mobile app has revolutionized the way people send and receive money, enabling users to make payments using their mobile devices. The app’s ease of use and security features have made it a popular choice among consumers.

- Robinhood: Robinhood’s mobile app has disrupted the investment industry by offering commission-free trading and a user-friendly interface. The app has attracted a large user base, particularly among millennials, who are looking for affordable investment options.

- Mint: Mint’s mobile app is a popular choice for personal finance management, offering features such as budget tracking, bill reminders, and credit score monitoring. The app’s comprehensive suite of tools has helped users take control of their finances.

- Ally Bank: Ally Bank’s mobile app has been praised for its simplicity and ease of use, offering features such as mobile check deposit, ATM locator, and peer-to-peer payments. The app has helped Ally Bank attract a younger, tech-savvy audience.

Conclusion

Mobile apps have transformed the finance industry, offering consumers and businesses convenient, accessible, and efficient financial services. With the rapid advancement of technology, finance mobile apps will continue to evolve, offering more personalized services and enhanced security measures. For developing a scalable finance app you must hire app developers in india. By embracing these trends and innovations, the finance industry can provide users with better financial management tools and experiences.