Hey there! Ever heard of Medigap? No, it’s not a patch for your jeans; it’s like a buddy for your Medicare! Let’s dive in and uncover what this Medigap thing is all about and why you might want to be buddies with it too.

What is Medicare Supplement Insurance and how does it work?

So, here’s the deal: Medicare is awesome, but it doesn’t cover everything. That’s where Medigap swoops in like a superhero. Medigap, short for Medicare Supplement Insurance, is like the Robin to your Medicare Batman. It helps pay for stuff that Medicare doesn’t cover fully, like copayments, coinsurance, and deductibles. So, you get extra coverage without breaking the bank!

What do Medigap plans cover?

Picture this: Medigap plans are like puzzle pieces that fill in the gaps left by Medicare. They’re like your extra shield against healthcare costs. Different plans cover different things, but generally, they help with stuff like hospital costs, doctor visits, and even some blood expenses. Just remember, they’re not the superheroes of everything. They won’t cover things like fancy glasses or your pet poodle’s checkup.

When is the best time to sign up for Medicare Supplement Insurance?

Timing is everything, my friend! The golden ticket to snagging the best Medigap plan is during your Medigap Open Enrollment Period. That’s like your VIP pass to Medigap land. It starts when you turn 65 and sign up for Medicare Part B. During this magical time, you can pick any Medigap plan you want, no questions asked! But once the clock strikes midnight in this period, it’s like Cinderella’s carriage turning into a pumpkin. So, don’t snooze on it!

Can I switch from Medicare Advantage to Medigap?

Absolutely! It’s like switching from one superhero squad to another. But, before you leap, there are a few things to consider. First off, make sure you can join a Medigap plan. And don’t forget to say goodbye to your Medicare Advantage plan first; it’s like breaking up with your old crew before joining the new one. Once you’re back to the original Medicare gang, you’re free to join the Medigap party!

Can doctors refuse to accept Medigap insurance?

Fear not! If a doctor accepts Medicare patients, they’re welcoming Medigap too. It’s like getting a warm hug from your favorite aunt. But remember to check if your doctor accepts your specific Medigap plan. Not all doctors are besties with every Medigap plan, you know!

Can I have both a Medigap and a Medicare Advantage plan?

Sorry, but it’s like trying to juggle two balls in one hand – it’s a no-go! You can’t have both at the same time. It’s against the rules, kinda like trying to wear socks with sandals. But hey, you can always switch back and forth between the two if you want a change of scenery.

The Medicare Supplement Plan Parts

Think of Medicare like a puzzle with different pieces:

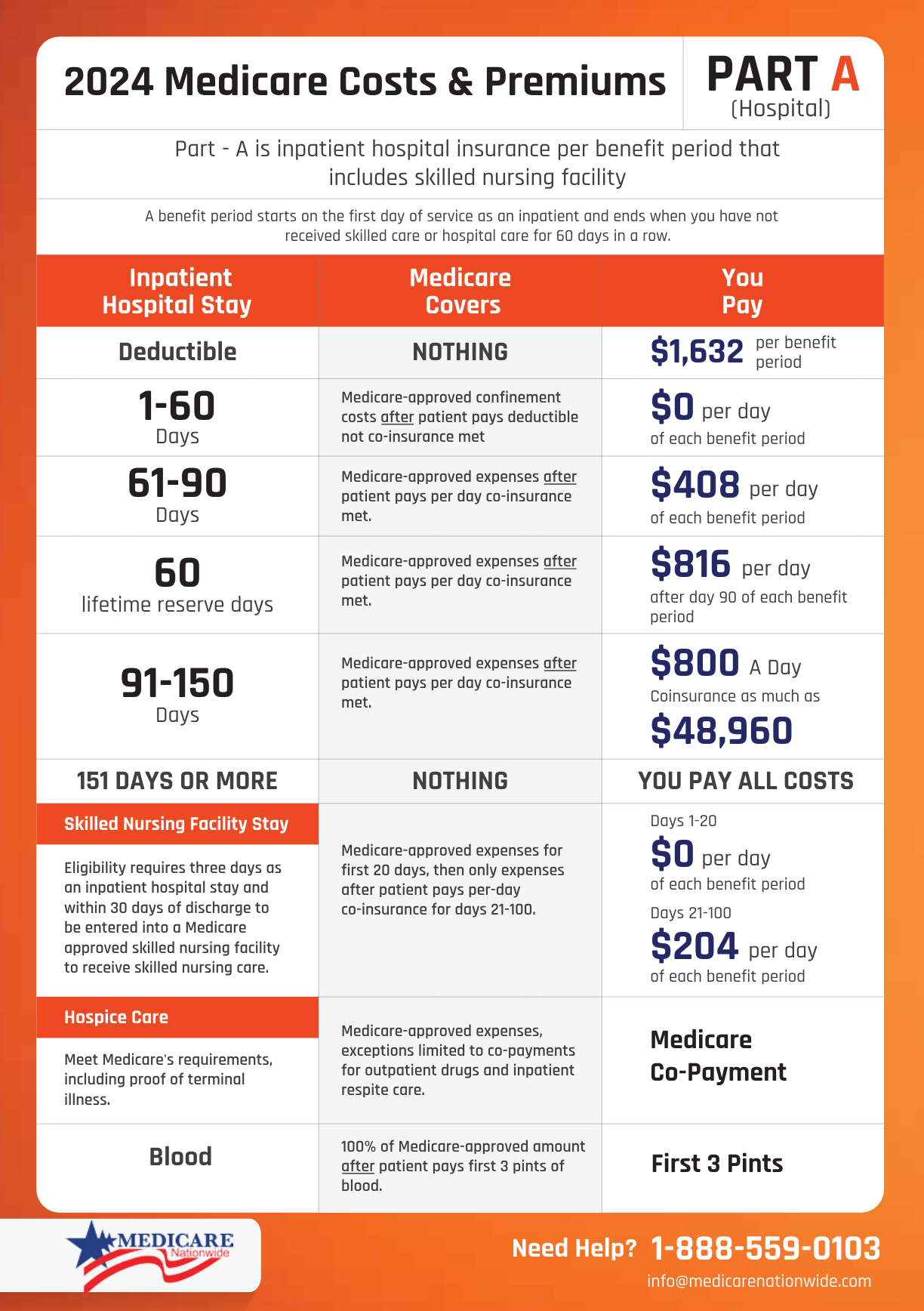

– Medicare Part A (Hospital Insurance): Medicare Part A covers your hospital stays and some other cool stuff.

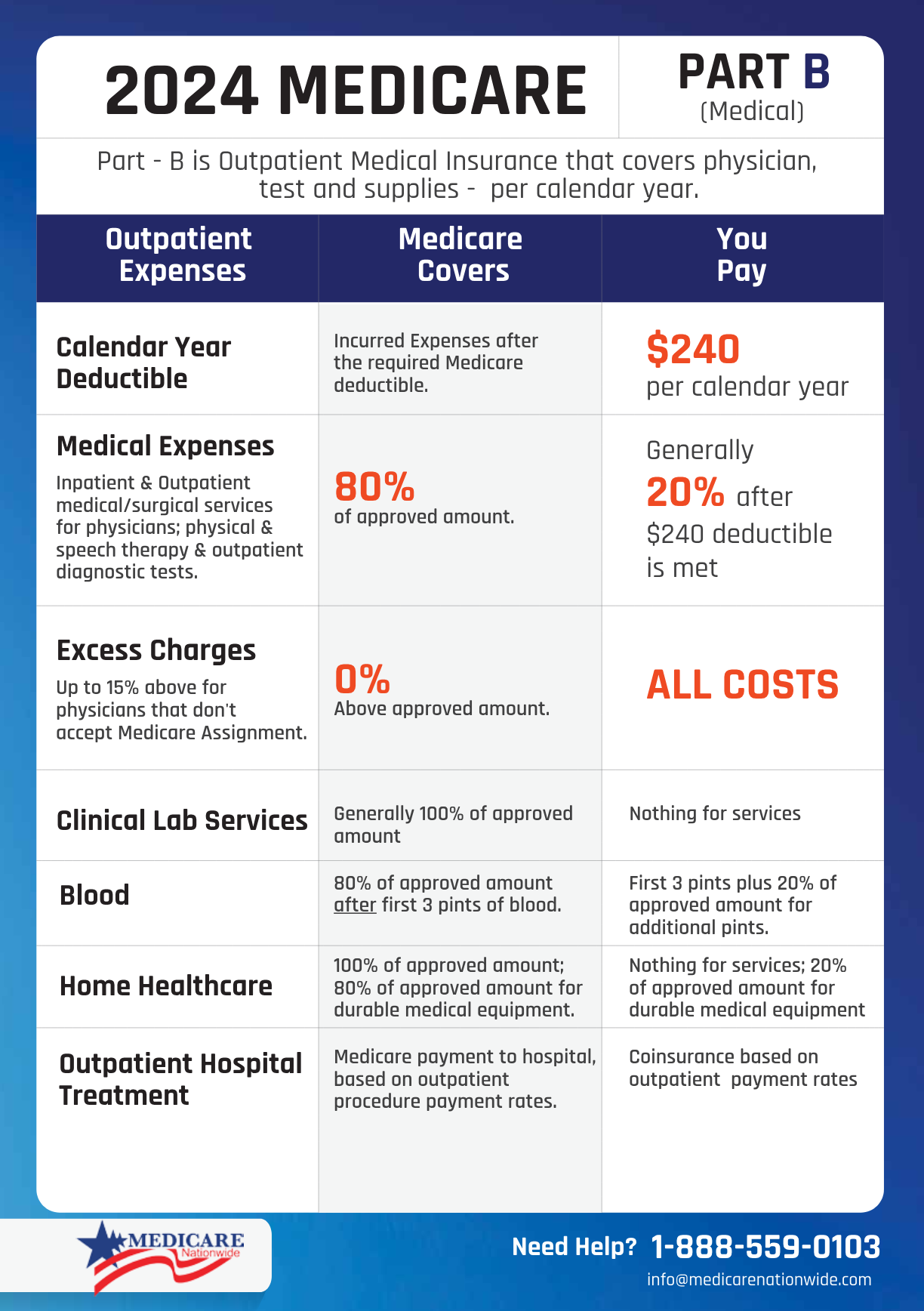

– Medicare Part B (Medical Insurance): Medicare Part B takes care of your doctor visits and other medical services.

– Medicare Part C (Medicare Advantage): Medicare Part C is like a combo meal that includes Parts A and B, plus some extra goodies.

– Medicare Part D (Prescription Drug Coverage): Medicare Part D handles your prescription drug costs like a boss.

Got it? Knowing these parts can help you navigate the Medicare maze like a pro!

In a nutshell, Medigap is like having an extra shield to protect you from healthcare costs. It’s there to fill in the gaps and make sure you’re covered when you need it most. So, if you’re thinking about getting Medigap, just remember to pick the plan that suits you best, and you’ll be all set for your healthcare adventures!