The National Common Mobility Card (NCMC), colloquially known as the “One Nation One Card,” is a pioneering initiative by the Government of India designed to streamline public transport payments across various modes nationwide. This innovative card system is more than just a travel pass; it is an integrated access and payment solution that significantly enhances the convenience of daily commutes and small-scale transactions. In this article, we explore what the National Common Mobility Card is, why it is beneficial, and how you can invest in it through Airtel Payment Banks.

Understanding the National Common Mobility Card (NCMC)

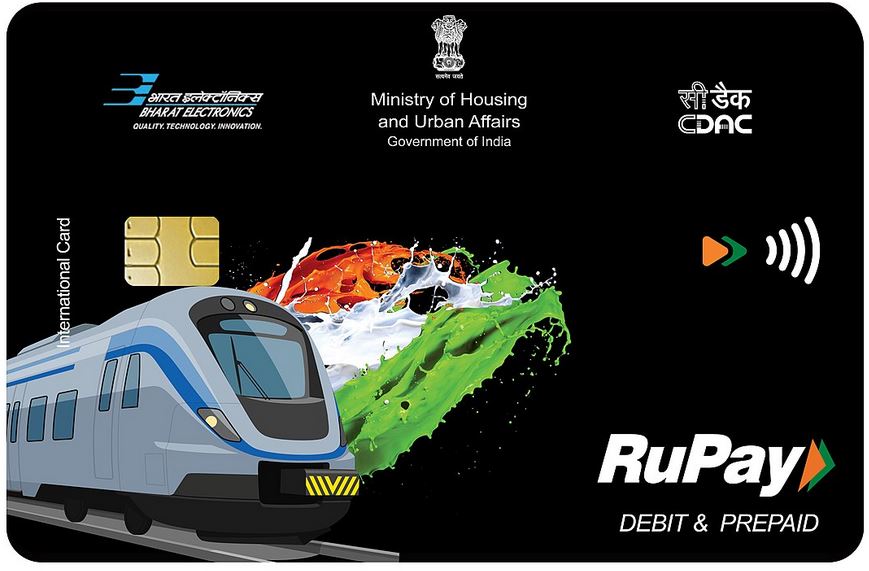

The National Common Mobility Card was launched with the objective of creating a seamless, hassle-free, and efficient public transport system across India. It uses Near Field Communication (NFC) technology, which allows users to tap their card on a reader to make payments. The NCMC serves multiple roles, functioning as a debit card, a credit card, and a prepaid card, facilitating not only travel but also retail shopping and online bill payments.

Key Features of NCMC:

- Universal Acceptance: The card can be used across all transport platforms, including metro, bus, suburban railways, and even parking lots, making it extremely versatile.

- Integrated Wallet: It allows for both physical (offline) and online transactions, enabling users to manage their spending efficiently.

- Secure Technology: Employs the latest in secure encryption technology to ensure that all transactions are protected.

Why Should You Invest in an NCMC Card?

1. Enhanced Convenience

The NCMC eliminates the need for multiple travel cards or cash transactions for daily commutes. With just one card, you can access various transport systems across the country. This convenience extends to non-transport transactions as well, such as retail purchases and online bill payments, including DTH recharge online.

2. Reduced Transaction Time

The contactless feature of the NCMC card speeds up transaction processes, drastically reducing the time spent at ticket counters or fare machines. This is particularly beneficial during peak travel hours, helping to decrease congestion and improve the overall efficiency of public transport systems.

3. Promotes Digital Economy

By facilitating easy access to digital payments, the NCMC card supports the Indian government’s vision of a digital economy. It encourages cashless transactions, which are not only secure, but also easier to track and manage.

4. Environmentally Friendly

The shift towards digital payments reduces the need for paper-based tickets and receipts, contributing to environmental conservation efforts by decreasing paper waste.

How to Apply for an NCMC Card Through Airtel Payments Bank

Investing in an NCMC card is straightforward, especially through platforms like Airtel Payments Bank. Here’s how you can apply:

Step 1: Access Airtel Payments Bank

Download and log into your Airtel Thanks App, and navigate to the Airtel Payments Bank section.

Step 2: NCMC Card

Click on ‘NCMC’ Enabled Card to enable the card application.

Step 3: Fill in the details

Enter all the necessary details and information that appears on your screen. Once all details are filled in and documents uploaded, submit your application. You might need to pay an issuance fee, depending on the terms set by Airtel Payments Bank.

Step 4: Activation

After your application is approved, your NCMC card will be linked to your Airtel Payments Bank account and will be ready for use once you receive and activate it.

The National Common Mobility Card is a revolutionary step towards enhancing urban mobility and promoting digital transactions across India. By investing in an NCMC card, you are not only making your daily travel more convenient but are also embracing a more secure, cashless, and environmentally friendly lifestyle.

Furthermore, with Airtel Payments Bank available through the Airtel Thanks App, managing your NCMC card and other financial transactions, including DTH recharge online, becomes effortless. Airtel also offers a range of DTH services that feature a wide selection of channels in multiple languages, flexible recharge options, and more, ensuring that your entertainment needs are as well catered to as your travel and financial transactions.