The problem of the shortage of automotive chips is still very serious so far. Since the outbreak of the shortage of chips in the automotive industry last year, news of car companies’ suspension of production has been reported frequently. In this context, Mike Hogan, senior vice president of GF Automotive Business, said in an interview on September 15: “The trend of automotive chip shortage will be more permanent. Compared with 2020, we will provide Automotive wafers have more than doubled.”Hogan revealed that GF also plans to continue to increase production capacity to solve the problem of insufficient wafer supply for automotive chips, but it will take time for capital investment to transform into actual production capacity. The expansion plan may not see results until 2023, and the shortage of automotive chip supply will continue for some time.

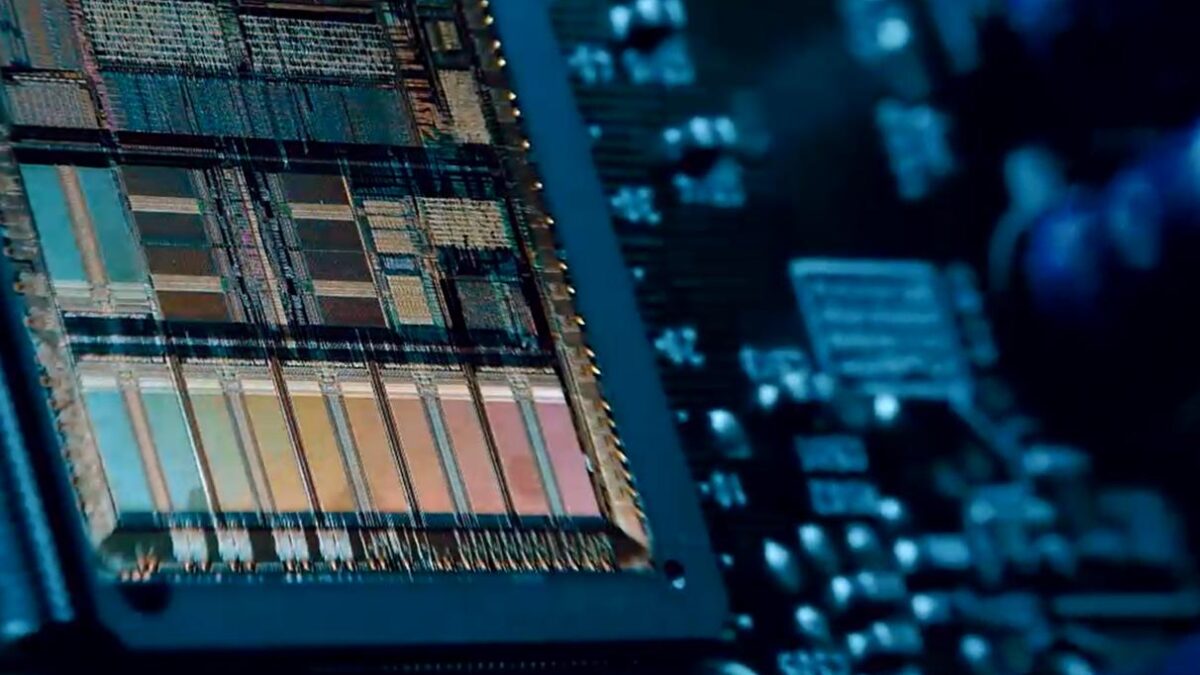

According to the latest survey by TrendForce, the output value of the top ten wafer foundries in the second quarter of this year reached US$24.4 billion, a quarterly increase of 6.2%. This is also the eighth consecutive quarterly record high since the third quarter of 2019. This shows that wafers are still in short supply. In the first half of the year, there is no obvious capacity expansion, and the momentum of pulling goods for various parts is still strong, and the capacity utilization rate of each factory is generally maintained at full capacity. In particular, since the second quarter of this year, a large amount of production capacity of automotive chips has been driven by governments in various countries, which has led to crowding out the production capacity of other products.

Currently, GF is investing more than US$6 billion globally to increase production capacity. On June 22 this year, GF announced the construction of a new 300mm (12-inch) wafer fab in the Singapore campus. GF has cooperated with the Singapore Economic Development Board, and at the same time, under the co-investment of committed customers, it has made more than 4 billion US dollars ( (Equivalent to 5 billion Singapore dollars) investment, plans to start production in 2023. After the new fab is put into production, GF will increase its annual production capacity of 450,000 wafers, and the production capacity of the Singapore production base will increase to approximately 1.5 million wafers (12 inches) per year.

On July 20, GF announced the construction of a new fab in Uptown, New York, United States through a “public-private partnership”. GlobalFoundries will invest US$1 billion. On the basis of the existing fab, the new factory can add 150,000 wafers a year to solve the problem of chip shortage. GLOBALFOUNDRIES said that the above-mentioned new capacity can be used in automotive products.

In order to alleviate the current capacity shortage, major fabs have announced their own expansion plans. TSMC, the world’s largest foundry company, announced in April that it would invest US$100 billion in the next three years to set up six fabs, including a US$12 billion 5nm plant in Arizona, USA. In addition, it will set up six 7nm factories in Kaohsiung, invest a US$200 million semiconductor packaging research and development center in Japan, and evaluate the feasibility of establishing wafer factories in Europe and Japan.

In May of this year, Samsung announced an investment of US$17 billion in the United States to build a new 5nm advanced process wafer fab in Texas. The Samsung Group also announced that its Samsung Electronics and other affiliated companies will invest a total of approximately US$205 billion in business expansion in the next three years, including semiconductors and communication technology. The industry speculates that most of the funds will be invested in the semiconductor business.

UMC, the world’s third largest foundry, is planning to expand the production capacity of its Fab 12A P6 plant in Nanke’s 12-inch fab, locking in the 28nm process, with a monthly production capacity of 27,500 wafers, and the customer will pay a deposit in advance at an agreed price to obtain the production capacity of the plant. , Is expected to start production in the second quarter of 2023. According to UMC’s plan, the total investment in the expansion of the P6 plant will reach NT$100 billion. The company expects that the total investment in Nanke will reach about NT$150 billion (35 billion yuan) in the next three years.

The expansion boom continues, but for downstream car companies, judging from the expansion plans of major foundries, most of the production time will be concentrated between 2023-2024, and the shortage of automotive chip supply is likely to continue. A long time.

Popular ic chip you may need:

TLE6209R

STR-Z2589

RJP56F4A

BA6110