Minimum coverage is the least pricey policy you can get for your car, but it only covers the minimum requirements by law from the state. With full coverage, you have extensive and crash coverage in addition to the minimum coverage. This alternative is more costly, it comes with more defense for your automobile.

Age is utilized to indicate just how much danger a motorist is to the insurance company. Young or inexperienced chauffeurs are a greater threat for the insurer, which is why they have greater insurance premiums. Once drivers are 30 or older, automobile insurance premiums are influenced by gender. Young male drivers may have a premium that’s 10 percent greater than that of a young female chauffeur.

The Only Guide to Consumer Price Index Summary – Bureau Of Labor Statistics

The six-month average cars and truck insurance premiums by gender are: Male: $734. 94As you can see, the distinction in premiums between adult male and adult female chauffeurs is negligible, though gender does have an effect on premiums for young drivers.

Sources: This material is produced and maintained by a third party, and imported onto this page to help users offer their email addresses. You might be able to find more details about this and comparable material at.

See This Report on Average Monthly Car Insurance Rates

The quantity you’ll spend for car insurance is impacted by a variety of extremely various factorsfrom the kind of protection you need to your driving record to where you park your car. While not all business use the exact same criteria, here’s a list of what commonly determines the bottom line on your vehicle policy.

If you’ve had mishaps or serious traffic infractions, it’s most likely you’ll pay more than if you have a tidy driving record. You might likewise pay more if you’re a brand-new chauffeur without an insurance performance history. The more miles you drive, the more opportunity for mishaps so you’ll pay more if you drive your cars and truck for work, or utilize it to commute fars away.

The smart Trick of Average Cost Of Car Insurance For October 2021 – Bankrate That Nobody is Discussing

Insurers generally charge more if teenagers or youths listed below age 25 drive your car. Statistically, women tend to get into less mishaps, have fewer driver-under-the-influence accidents (DUIs) andmost importantlyhave less major mishaps than men. So all other things being equal, ladies often pay less for automobile insurance than their male equivalents.

, and the types and quantities of policy choices (such as accident) that are prudent for you to have all affect how much you’ll pay for protection.

The Greatest Guide To Average Car Insurance Costs In 2020 – Business Insider

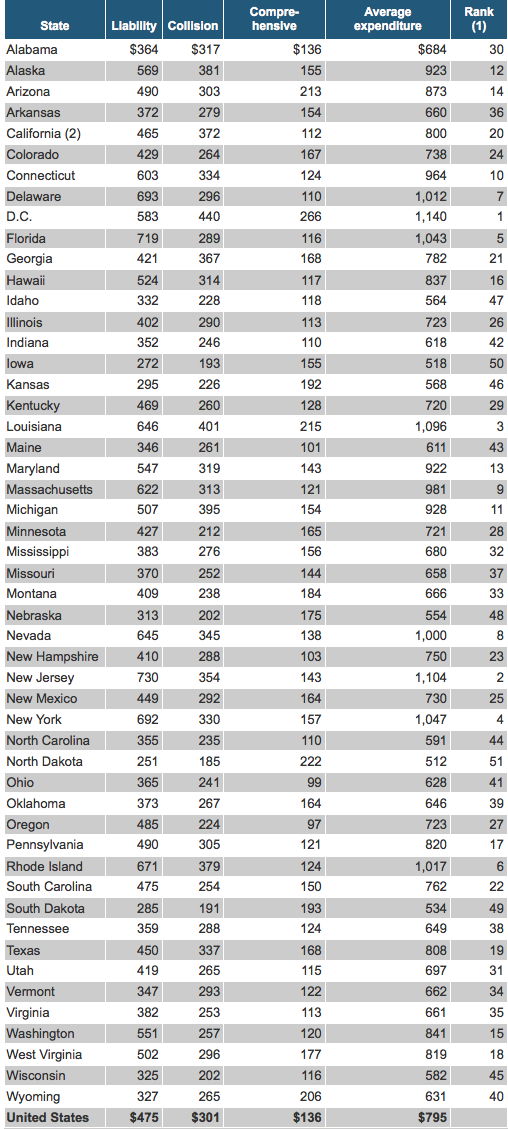

The average expense of vehicle insurance in the U.S. is around $1,652 each year (or about $137 each month), based on rates for 30-45-year-old chauffeurs, according to a 2021 analysis of car insurance rates by Policygenius. Cars and truck insurance rates are various for every driver, which makes it tough to forecast what you’ll pay for coverage.

The cheapest states for automobile insurance generally have lower minimum protection requirements, suggesting you can conserve by pulling out of specific types of coverage. Idaho, for instance, does not mandate injury protection (PIP), which is required in no-fault states and covers your injuries after a mishap, or uninsured/underinsured driver protection, which covers damage triggered by a motorist without insurance coverage.

Excitement About Average Car Insurance Costs In Washington – Smartfinancial

Younger, less skilled drivers pay more because they’re more most likely to have a mishap and file a claim. Your gender can likewise have an effect on your rates, although some states don’t allow car insurer to utilize gender as an aspect when determining how much to charge for protection.

You ought to still have relatively high liability limitations, even if your vehicle is a clunker, since you might quickly cause countless dollars worth of damage in a mishap. If your car is worth less than a common extensive or accident deductible and you would be great paying out of pocket to replace it if it were taken, you can limit your protection to liability-only, and conserve by not paying for compensation and crash.

Unknown Facts About How Will Your Social Security Benefits Stack Up To The …

How Much Is Vehicle Insurance Coverage per Month? Chauffeurs in the United States invest an average of $1,251 per year2 on automobile insurance coverage, making the average car insurance cost each month $104. Check out this site This average rate is based upon a complete coverage policy for a driver under 65 years old who has more than six years of driving experience and a clean driving record.

We have actually made a reputation for integrity and trust, and we’re proud to have a record of high consumer rankings for claims services. If you live in a location where your danger of being in an accident is higher, your insurance prices may be higher.

Little Known Facts About Average Cost Of Car Insurance Rates: How Much Is … – Insurify.

Here are a few elements that will affect your insurance quotes: Driving history Credit report Age Postal code Automobile Insurance Business Average Monthly Cost of Car Insurance Coverage by Automobile Type The type of car you drive can also affect your automobile insurance coverage rate. In many cases, car insurer might charge more for protection on certain types of cars, consisting of: Owning an automobile that is typically stolen can suggest that your thorough insurance rates are higher.

These kinds of cars are typically more expensive to repair if they are damaged. In the case of luxury vehicles, they’re typically more costly to replace if they’re totaled from a car accident. Since these vehicles can take a trip at greater speeds, people might drive them much faster and be most likely to get in a mishap or get a traffic infraction.

All about Monthly Or Annual Auto Insurance Premium: Which Is Best For …

Chauffeurs under 25 have less experience on the road and studies reveal they cause more mishaps. 3 So, if you or somebody on your policy is under 25 years of ages, your car insurance premiums may be higher. Auto insurance rates may reduce after a driver turns 25, particularly if they haven’t had any at-fault accidents.

Generally, if you’re over 25 but below 60 years of ages, your car insurance expense each month will be the most affordable. If you’re not within that age variety, you can still discover ways to save. We provide many unique rates and discounts with the AARP Automobile Insurance Coverage Program from The Hartford.

Car Insurance Rates By State For 2021 – Coverage.com Fundamentals Explained

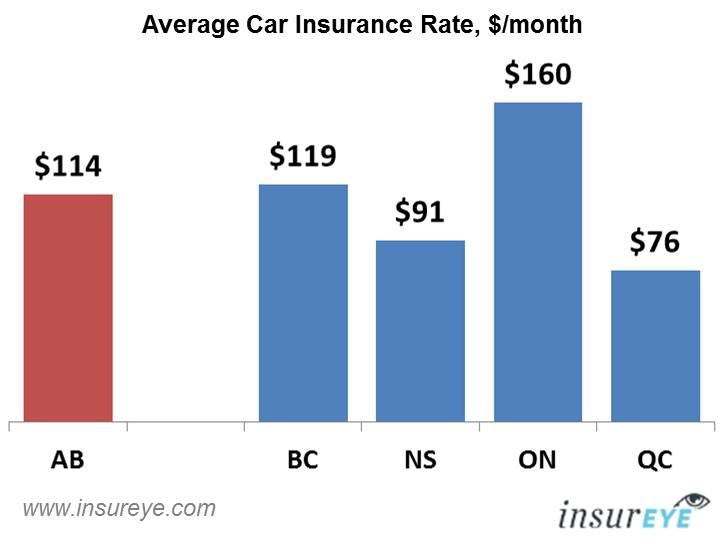

If you have an AARP subscription, get a car insurance coverage quote today and conserve. How Much Is the Typical Car Insurance Coverage each month in My State? Automobile insurance rates vary based on which of the 50 states you reside in. It can be tough to compare all state auto insurance rates.