The indicator of Resistance and Support is MT4 and Breakout signals

Simply stated, a support zone is where the price of an asset tends to stabilize while a resistance zone is where an asset’s price tends to cease increasing.

Support and resistance levels for trading are among the most well-known and frequently used techniques by traders. Numerous indicators that are supportive for forex and binary trading have been created. In a market that is trending there are important price action levels, also known as Reversal points.

Since these are the areas in which a significant amount of trading actions took place after an impulsive breakout as well as a Crossed Key Level, horizontal support and resistance are the two pillars for technical analyses.

The indicator for resistance and support can be used to adjust several Timeframe key levels. It’s an extremely effective indicator that can be used to identify high-risk Reversal points.

The Metatrader4 Platform indicator can trade forex and binary options at both high and medium frequency news releases in times when the market is volatile.

How do you use non-repainting support and Resistance indicator

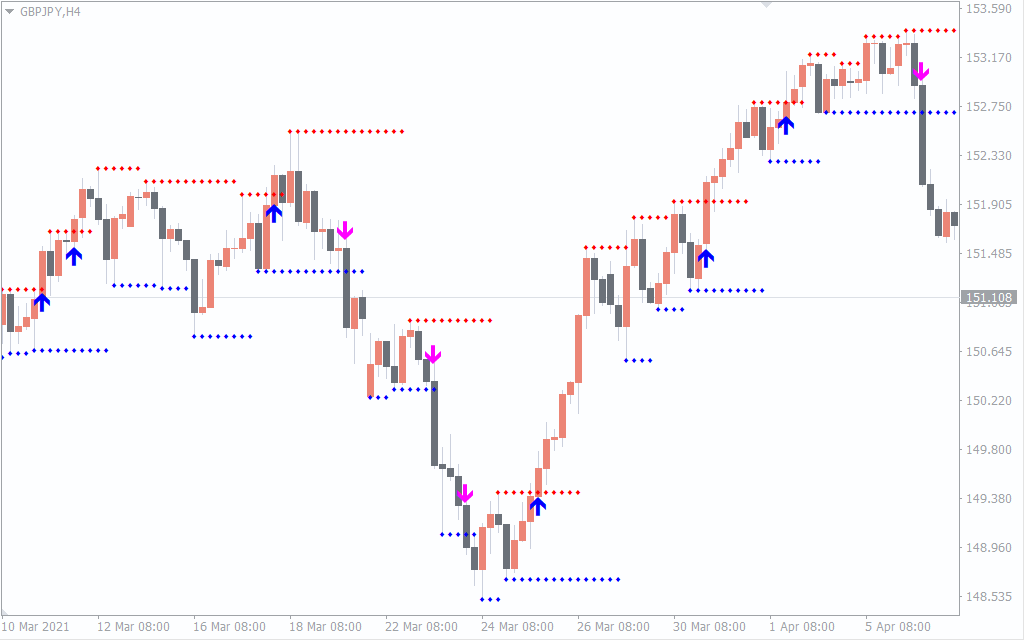

- The Blue dots indicate an area of support. If it’s broken, it could function as resistance.

- The Red dots signify the level of resistance if it is broken, which could serve as a source of support.

Purchase trades: The blue buy signal arrow is located on the top of the price and the arrows indicate the price’s return back to the support and resistance zones breaking. All possible trades to use in the strategy you use to trade.

Sell trading: The Red Sell signal arrow is located on the top of the price and the arrows depict the price’s return back to the resistance level to break support zones. There are a variety of possible trades to sell for an effective trading plan.

Stop loss targets can be adjusted by using the indicator of Support and Resistance.

-

- You can also create price targets based on the historical levels of resistance and support. Making stops trailing behind each plot is an excellent alternative.

- Your stop loss could be placed over or below the previous chart of resistance or support.

- The trading of supports and resists is determined by the price structure. When it comes to technical analysis, such as support and resistance are dependent on the prior pricing, it’s not a method to calculate.

It is interesting that in default, there’s no indicator available in the MT4 terminal that will automatically create resistance and support levels. These levels are among the main components of the technical analysis traders rely on. It is the Auto Support & Resistance indicator solves this issue.

Indicator description

Its support and resistance indicator mt4 automatically plots the most important levels of resistance and support on the chart.

The levels of resistance (zones) are highlighted with red on the chart. Support zones (zones) are highlighted with blue. Support levels signal potential buyers’ attention when the price is close to them.

The resistance levels suggest the reverse and could indicate buyers’ attention if prices rise to levels that are similar to those.

The automatic drawing of levels of resistance and support by the indicator will allow you to cut down on time and effort while studying the chart. This is certainly an advantage for experts and novice traders.

However, for those who are new to forex it is recommended to draw the levels by hand. This will help increase the understanding and experience of the pricing process in the market for forex. In the event of manual drawing of resistance and support levels, the levels drawn automatically are considered to be examples as well as a type of assistance.

The levels of support and resistance that are displayed by the indicator can be used as a guideline to place orders after close positions (stop-loss as well as take-profit). Additionally, they can help identify the signals needed to open the transactions.

Indicator drawing technique

The levels of resistance and support generally are drawn with market extrema, which is also known as Fractals. The normal set of indicators within the MT4 terminal includes one indicator, the Fractals indicator. It shows these extremes.

This Resistance and Support Resistance indicator already has it’s Fractals indicator. It shows the levels of support and resistance at the locations in which fractals were the most abundant.

This resistance level in this instance is constructed based on 11 fractals. You can determine which fractals the level was constructed in accordance with by clicking the number at the bottom at the top of the resistance levels.

The strength of resistance and support levels is dependent on how far they are from one and from each.

The more distance the lower and upper levels of the support/resistance fractal is, the greater the elevation of the level plotted will be.

Also, the reverse is true that the closer the lower and upper levels of the fractals are placed to each other and the higher its level’s height will be.

The indicator therefore doesn’t redraw, but alters the height of the levels when new fractals are discovered.

Trading with this indicator

The trading strategies that are based on support and resistance zones are typically described as signals to breakout or rebound from levels. However, the trade-specifics of these techniques differ for trend and flat.

Trading from the lower limit to the upper limits of flats or vice versa generally speaking one of the most simple and most profitable strategies for trading.

However, it is crucial to realize that flats are only temporary within the market for forex. In the near future, the flat may be replaced with the trend.

The combination of resistance and support zones here creates an elongated flat.

roboforex login

Based on the technical analysis it appears that the likelihood for breaking the plateau is greater in the direction the trend was initially oriented prior to the flat. So we believe that the possibility of breaking up in the zone of resistance is more likely as opposed to a downward trend.

This allows you to consider purchase trades coming from the support zone throughout the daytime trading. This also lets you consider the trades that could result in a breakout of the flat upwards over the long and mid-term.

In the active trend phase when the zones of support and resistance are used as levels. Based on these zones, it’s possible to profit from a trade that is in the trend’s main direction.

The combination of trend lines as well as support and resistance zones in trading systems initially increase the chance of an agreement that is successful.

Let’s take a look at this AutoTrendLines indicator to identify the trend.