In the ever-expanding landscape of cryptocurrency trading, the decision between using a centralized exchange (CEX) or a decentralized exchange (DEX) can significantly impact your trading experience. Here’s a quick breakdown to help you make an informed choice:

Centralized Exchanges (CEX):

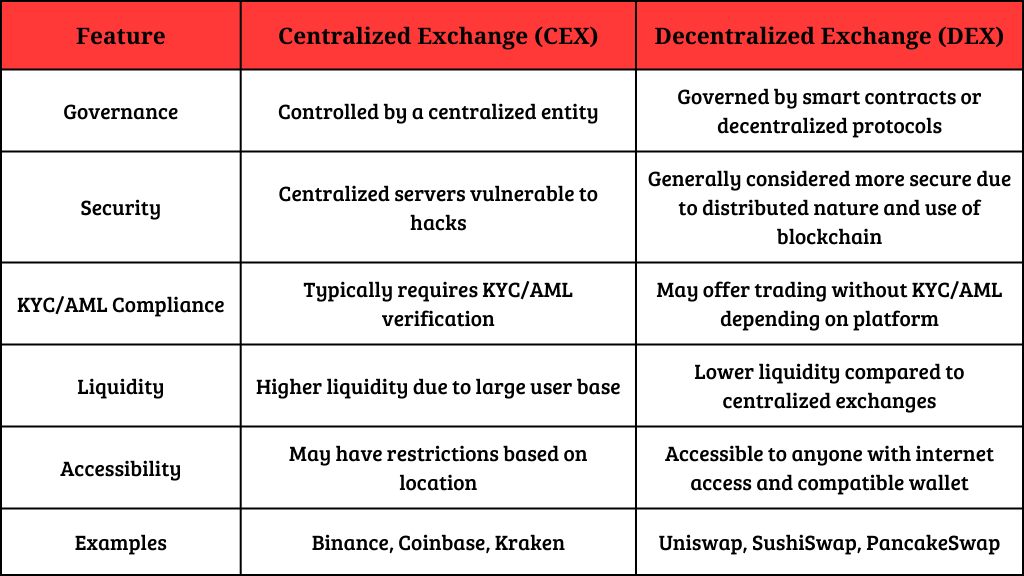

Centralized exchanges are operated by a single entity, offering users a familiar trading environment similar to traditional financial markets. They often provide higher liquidity, faster transaction speeds, and a wide range of trading pairs. However, this convenience comes with trade-offs. You’ll typically need to undergo KYC/AML verification, entrust the exchange with custody of your funds, and may encounter higher trading fees.

Decentralized Exchanges (DEX):

Decentralized exchanges, on the other hand, operate on blockchain technology, enabling peer-to-peer trading without the need for a central authority. This decentralized nature offers enhanced security, as your funds remain in your control throughout the trading process. While DEXs may have lower liquidity and slower transaction speeds compared to CEXs, they often boast lower trading fees and a higher degree of anonymity. Plus, they’re accessible to anyone with an internet connection and compatible wallet, without geographic restrictions.

So, which one is right for you? Consider your priorities:

if you value convenience, high liquidity, and fast transactions, a centralized exchange might be the way to go. However, if you prioritize security, control over your funds, and a more decentralized approach to trading, then a decentralized exchange could better align with your needs.

Ultimately, the choice between centralized and decentralized exchanges depends on your preferences, risk tolerance, and trading goals. Take the time to research and understand the features of each type of exchange before making your decision. Happy trading!

click here for more info>> [email protected]

Whatsapp: +91 9500575285